Exhibit 99.1

Information contained herein is subject to completion or amendment. A registration statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission.

SUBJECT TO COMPLETION, Dated December 14, 2012

INFORMATION STATEMENT

LIBERTY SPINCO, INC.

12300 Liberty Boulevard

Englewood, Colorado 80112

Series A Common Stock

(par value $0.01 per share)

Series B Common Stock

(par value $0.01 per share)

Liberty Spinco, Inc. (Spinco) is currently a subsidiary of Liberty Media Corporation. Liberty Media Corporation has determined to spin off our company by distributing (the distribution) to its stockholders, as a dividend, all of our common stock. We are sending this information statement to you in connection with that spin-off (the Spin-Off). Following the Spin-Off, we will be primarily engaged in the media, communications and entertainment industries through our operating subsidiaries and investments in various publicly-traded companies.

If all conditions to the Spin-Off are satisfied or waived by the board of directors of Liberty Media Corporation in its sole discretion, at 5:00 p.m., New York City time, on [ ], 2012 (such date and time, the distribution date), (i) for each whole share of Liberty Media Corporation's Series A Liberty Capital common stock (LMCA) held by you as of 5:00 p.m., New York City time, on [ ], 2012 (such date and time, the record date) you will receive one share of our Series A common stock and (ii) for each whole share of Liberty Media Corporation's Series B Liberty Capital common stock (LMCB, and together with LMCA, the Liberty Media common stock) held by you on the record date you will receive one share of our Series B common stock.

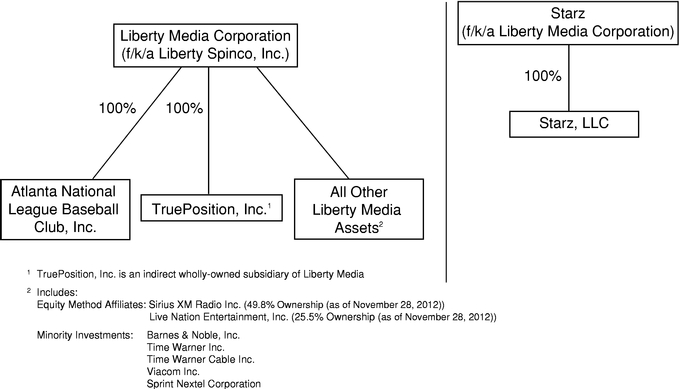

In connection with the Spin-Off, Liberty Media Corporation will be renamed "Starz," and Liberty Spinco, Inc. will change its name to "Liberty Media Corporation." Throughout this information statement, we refer to the current Liberty Media Corporation prior to the Spin-Off as Liberty Media and following the Spin-Off as Starz.

No vote of Liberty Media's stockholders is required to authorize or effectuate the Spin-Off. No action is required of you to receive your shares of our common stock.

There is no current trading market for our common stock. We expect to list our Series A common stock and Series B common stock on the Nasdaq Global Select Market under the symbols "LMCA" and "LMCB," respectively, which are the current trading symbols for Liberty Media's Series A and Series B Liberty Capital common stock, respectively. Following the Spin-Off, Starz will change the symbols of its Series A and Series B Liberty Capital common stock to "STRZA" and "STRZB," respectively. For a short period of time following the Spin-Off, our common stock will trade under temporary trading symbols, which will be announced by press release once available.

In reviewing this information statement, you should carefully consider the matters described under the caption "Risk Factors" beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has passed upon the adequacy or accuracy of this information statement as truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or a solicitation of an offer to buy any securities.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The date of this information statement is [ ], 2012.

SUMMARY |

1 | ||

Our Company |

1 | ||

The Spin-Off |

2 | ||

RISK FACTORS |

9 |

||

Factors Relating to our Businesses |

9 | ||

Factors Relating to the Spin-Off |

15 | ||

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS |

20 |

||

THE SPIN-OFF |

22 |

||

Background for the Spin-Off |

22 | ||

Reasons for the Spin-Off |

22 | ||

Interests of Certain Persons |

24 | ||

Conditions to the Spin-Off |

25 | ||

Manner of Effecting the Spin-Off |

26 | ||

Effect of the Spin-Off on Outstanding Liberty Media Incentive Awards |

26 | ||

Material U.S. Federal Income Tax Consequences of the Spin-Off |

28 | ||

Results of the Spin-Off |

31 | ||

Listing and Trading of our Common Stock |

31 | ||

Trading Prior to the Record Date |

32 | ||

Reasons for Furnishing this Information Statement |

32 | ||

SELECTED FINANCIAL DATA |

33 |

||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

37 |

||

DESCRIPTION OF OUR BUSINESS |

62 |

||

Overview |

62 | ||

Other Minority Investments |

74 | ||

Geographic Areas |

75 | ||

Regulatory Matters |

75 | ||

Competition |

76 | ||

Employees |

77 | ||

Properties |

77 | ||

Legal Proceedings |

78 | ||

MANAGEMENT |

79 |

||

Directors |

79 | ||

Executive Officers |

85 | ||

Directors and Executive Officers |

85 | ||

Director Independence |

86 | ||

Board Composition |

86 | ||

Committees of the Board |

86 | ||

EXECUTIVE COMPENSATION |

87 |

||

Equity Incentive Plans |

88 | ||

Equity Compensation Plan Information |

89 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

90 |

||

Security Ownership of Certain Beneficial Owners |

90 | ||

Security Ownership of Management |

91 | ||

Change of Control |

94 |

i

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

95 | ||

Relationships Between Spinco and Liberty Media/Starz and/or Liberty Interactive |

95 | ||

DESCRIPTION OF OUR CAPITAL STOCK |

104 |

||

Authorized Capital Stock |

104 | ||

Our Common Stock |

104 | ||

Our Preferred Stock |

105 | ||

Other Provisions of our Certificate of Incorporation and Bylaws |

106 | ||

Section 203 of the Delaware General Corporation Law |

109 | ||

Transfer Agent and Registrar |

109 | ||

INDEMNIFICATION OF DIRECTORS AND OFFICERS |

110 |

||

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

111 |

||

WHERE YOU CAN FIND MORE INFORMATION |

111 |

||

FINANCIAL STATEMENTS |

F-1 |

This information statement describes the businesses and assets of our company as though they were our businesses and assets for all historical periods described. However, our company is a newly formed entity that will not have conducted any operations prior to the Spin-Off and instead will have had such businesses and assets transferred to it prior to the Spin-Off. References in this information statement to the historical assets, liabilities, businesses or activities of our businesses or the businesses in which we have interests are intended to refer to the historical assets, liabilities, businesses or activities as they were conducted or held by Liberty Media prior to the Spin-Off. Following the Spin-Off, we will be an independent publicly traded company, and Starz will have no continuing stock ownership in our company. The historical consolidated financial information of our company as part of Liberty Media contained in this information statement is not necessarily indicative of our future financial position, future results of operations or future cash flows, nor does it reflect what the financial position, results of operations or cash flows of our company would have been had we been operated as a stand-alone company during the periods presented.

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover page of this information statement. Changes to the information contained herein may occur after that date and we do not undertake any obligation to update the information unless required to do so by law.

ii

The following is a summary of material information discussed in this information statement. It is included for convenience only and should not be considered complete. You should carefully review this entire information statement, including the risk factors, to better understand the Spin-Off and our business and financial position.

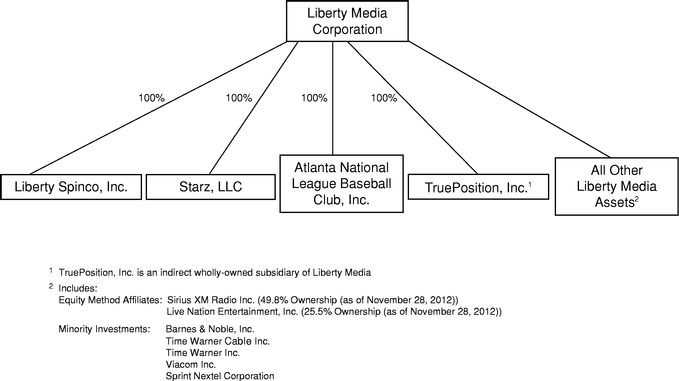

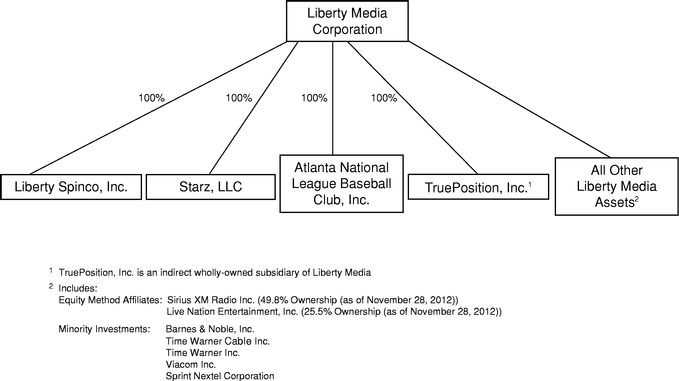

Spinco is currently a wholly owned subsidiary of Liberty Media. Immediately following the Spin-Off, we will be primarily engaged in the media, communications and entertainment industries through our ownership of interests in subsidiaries and other companies. Following the Spin-Off, our principal businesses and assets will include the consolidated subsidiaries Atlanta National League Baseball Club, Inc. (ANLBC) and TruePosition, Inc. (TruePosition), equity affiliates Sirius XM Radio Inc. (Sirius) and Live Nation Entertainment, Inc. (Live Nation) and minority investments in public companies such as Barnes & Noble, Inc. (Barnes & Noble), Time Warner Inc., Time Warner Cable Inc., Viacom Inc. and Sprint Nextel Corporation. In connection with the Spin-Off, it is expected that Starz, LLC will distribute approximately $1.8 billion in cash to Liberty Media, of which $600 million in the aggregate has already been distributed (on July 9, August 17, September 4 and November 16 of 2012). The total amount of the distribution will depend upon the financial performance and cash position of Starz, LLC prior to the Spin-Off. This distributed cash, as reduced by investments of such cash prior to the Spin-Off, will be contributed to Spinco in connection with the Spin-Off. The distribution of a minimum amount of cash by Starz, LLC to Liberty Media, and its contribution to Spinco, is not a condition to the Spin-Off. See "The Spin-Off—Conditions to the Spin-Off."

The businesses and assets that remain at Starz following the Spin-Off will consist of the premium movie service provider Starz, LLC and its subsidiaries.

The restructuring of Liberty Media prior to and in connection with the Spin-Off is sometimes referred to herein as the internal restructuring and is provided for in a reorganization agreement to be entered into by our company and Liberty Media. For a description of the reorganization agreement, see "Certain Relationships and Related Party Transactions—Relationships Between Spinco and Liberty Media/Starz and/or Liberty Interactive—Reorganization Agreement."

Based on pro forma information, the percentage of revenue, total assets and total liabilities of Liberty Media, as of September 30, 2012, December 31, 2011 and December 31, 2010, attributable to the businesses and liabilities that will (i) be transferred to Spinco in connection with the Spin-Off and (ii) remain with Starz are as follows:

| |

Revenue | Total Assets | Total Liabilities | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

September 30, 2012 |

||||||||||

Spinco |

21 | % | 73 | % | 58 | % | ||||

Starz |

79 | % | 27 | % | 42 | % | ||||

December 31, 2011 |

||||||||||

Spinco |

47 | % | 67 | % | 60 | % | ||||

Starz |

53 | % | 33 | % | 40 | % | ||||

December 31, 2010 |

||||||||||

Spinco |

21 | % | 83 | % | 94 | % | ||||

Starz |

79 | % | 17 | % | 6 | % | ||||

See "Selected Financial Data—Selected Unaudited Condensed Pro Forma Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

1

When we refer to "our business" in this information statement, we are referring to the business of Spinco and its respective subsidiaries and affiliates following the Spin-Off. Following the Spin-Off, we will be an independent publicly traded company and Starz will not retain any ownership interest in us. In accordance with generally accepted accounting principles (GAAP), Spinco will be treated as the "accounting successor" to Liberty Media Corporation for financial reporting purposes following the Spin-Off (as discussed below). In connection with the Spin-Off, we and Liberty Media/Starz are entering into certain agreements, including the reorganization agreement and a tax sharing agreement, pursuant to which we and Starz will, among other things, indemnify each other against certain liabilities that may arise from our respective businesses. See "Certain Relationships and Related Party Transactions—Relationships Between Spinco and Liberty Media/Starz and/or Liberty Interactive."

Our principal executive offices are located at 12300 Liberty Blvd., Englewood, Colorado 80112. Our main telephone number is (720) 875-5300.

The following is a brief summary of the terms of the Spin-Off. Please see "The Spin-Off" for a more detailed description of the matters described below.

2

and that for U.S. federal income tax purposes, (i) no gain or loss will be recognized by Liberty Media upon the distribution of our common stock in the Spin-Off, and (ii) no gain or loss will be recognized by, and no amount will be included in the income of, holders of Liberty Media common stock upon the receipt of shares of our common stock;

In the event the Liberty Media board of directors waives a material condition to the Spin-Off, Liberty Media intends to promptly issue a press release and file a Current Report on Form 8-K to report such event. See "The Spin-Off—Conditions to the Spin-Off."

3

Prior to the Internal Restructuring & the Spin-Off

4

Following the Spin-Off

For a discussion of additional reasons, factors, costs and risks associated with the Spin-Off considered by the Liberty Media board, see "The Spin-Off—Reasons for the Spin-Off."

5

Please see "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off" and "Risk Factors—Factors Relating to the Spin-Off—The Spin-Off could result in a significant tax liability" and "—Spinco may have a significant indemnity obligation to Starz, which is not limited in amount or subject to any cap, if the Spin-Off is treated as a taxable transaction" for more information regarding the Ruling, the tax opinion and the potential tax consequences to you of the Spin-Off.

6

We expect that our common stock will begin trading on the first trading day following the distribution date. We expect our common stock to trade under temporary trading symbols for no more than 30 days following the Spin-Off, beginning on the first day of trading following the distribution date, so as to avoid market confusion once our common stock begins trading under Liberty Media's current trading symbols. These temporary symbols will be announced by press release once available. We cannot predict the trading prices for our common stock when such trading begins.

Liberty Media's board concluded that the potential benefits of the Spin-Off outweighed its potential costs. Please see "The Spin-Off—Reasons for the Spin-Off" for more information regarding the costs and risks associated with the Spin-Off.

7

common stock, which currently trades under the symbols "LMCA" and "LMCB," respectively, will change its trading symbols to "STRZA" and "STRZB," respectively.

Pursuant to a services agreement to be entered into between our company and Liberty Media, we will provide Starz with investor relations assistance for a period following the Spin-Off. Accordingly, if you have questions relating to Spinco or Starz following the Spin-Off, you should contact the office of Investor Relations of Spinco at the address and telephone number above.

8

An investment in our common stock involves risk. You should carefully consider the risks described below, together with all the other information included in this information statement, in evaluating our company and our common stock. Any of the following risks, if realized, could have a material adverse effect on the value of our common stock. The risks described below and elsewhere in this information statement are not the only ones that relate to our businesses, our capitalization or the Spin-Off. The risks described below are considered to be the most material. However, there may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that also could have material adverse effects on our businesses. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. If any of the events described below were to occur, our businesses, prospects, financial condition, results of operations and/or cash flows could be materially adversely affected.

For purposes of these risk factors, unless the context otherwise indicates, we have assumed that the Spin-Off has occurred.

Factors Relating to our Businesses

The historical consolidated financial information of Liberty Media and the unaudited condensed pro forma financial information of Spinco included in this information statement are not necessarily representative of Spinco's future financial position, future results of operations or future cash flows nor do they reflect what Spinco's financial position, results of operations or cash flows would have been as a stand-alone company during the periods presented.

As described elsewhere in this information statement, Spinco will be considered the divesting entity in the Spin-Off and treated as the "accounting successor" to Liberty Media Corporation for financial reporting purposes in accordance with GAAP due to the relative significance of our company to Starz (which is the legal spinnor) and the continued involvement of senior management with Spinco following the Spin-Off. Following the consummation of the Spin-Off, Spinco will report the historical consolidated results of operations of the legacy Starz businesses in discontinued operations. This presentation is generally not permitted until the closing date of the Spin-Off. Because the historical consolidated financial information of Liberty Media included in this information statement includes the results of the legacy Starz business, it is not representative of Spinco's future financial position, future results of operations or future cash flows nor does it reflect what Spinco's financial position, results of operations or cash flows would have been as a stand-alone company during the periods presented.

The unaudited condensed pro forma financial information of Spinco included in this information statement includes adjustments to reflect the divestiture of the legacy Starz businesses. The pro forma adjustments are based upon available information and assumptions that management of Spinco believes are reasonable; however, such assumptions may not prove to be accurate or are subject to change. In addition, the unaudited condensed pro forma financial statements of Spinco do not give effect to on-going costs that it may incur or may be eliminated in connection with being a stand-alone company. Accordingly, the unaudited condensed pro forma financial statements of Spinco are not representative of Spinco's future financial position, future results of operations or future cash flows nor do they reflect what Spinco's financial position, results of operations or cash flows would have been as a stand-alone company during the periods presented.

In addition, in the third quarter of 2011, Liberty Media completed the Split-Off. Prior to the Split-Off, the assets, liabilities and businesses of our company at that time were part of the larger Liberty Interactive organization. Hence, portions of Liberty Media's historical financial information were also extracted from Liberty Interactive's consolidated financial statements for the relevant periods prior to the Split-Off. As a result, our historical financial information may not necessarily reflect what our respective results of operations, financial condition and cash flows would have been had we existed

9

as a separate, stand-alone entity pursuing independent strategies during the periods presented. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Financial Statements."

As a result of the Spin-Off, we will not have access to the cash flow generated by Starz, LLC. For the past three fiscal years, a significant portion of Liberty Media's reported total revenue has been generated by the businesses of Starz, LLC. Prior to the Split-Off, Starz, LLC was the second-largest generator of cash flow for Liberty Media's former parent company, Liberty Interactive (the largest generator being QVC, Inc., which is currently a subsidiary of Liberty Interactive). As a result of and following the Spin-Off, Spinco will not have access to the cash flow generated by Starz, LLC. Additionally, the remainder of Liberty Media's businesses which will become the businesses of Spinco following the Spin-Off either (i) have historically generated cash flows at a comparatively lower level than that historically generated by Starz, LLC or (ii) will not be majority owned subsidiaries of Spinco and Spinco will therefore not have access to the cash flow they generate. Thus, as a result of and following the Spin-Off, Splitco will not have any significant annual operating cash flow.

Certain of our subsidiaries and business affiliates depend on their relationships with third party distribution channels, suppliers and advertisers and any adverse changes in these relationships could adversely affect our results of operations. An important component of the success of our subsidiaries and business affiliates, including TruePosition and Sirius, is their ability to maintain their existing, as well as build new, relationships with third party distribution channels, including local and national satellite providers, suppliers, manufacturers, retailers and advertisers, among other parties. Adverse changes in existing relationships or the inability to enter into new arrangements with these parties on favorable terms, if at all, could have a significant adverse effect on our results of operations.

Rapid technological advances could render the products and services offered by our subsidiaries and business affiliates obsolete or non-competitive. Our subsidiaries and business affiliates, including, for example, TruePosition, Sirius, Barnes & Noble and Live Nation, must stay abreast of rapidly evolving technological developments and offerings to remain competitive and increase the utility of their products and services. These subsidiaries and business affiliates must be able to incorporate new technologies into their products and services in order to address the needs of their customers. There can be no assurance that they will be able to compete with advancing technology, and any failure to do so could result in customers seeking alternative service providers thereby adversely impacting our revenue and operating income.

The business of our affiliate Sirius depends in significant part on the operation of its satellites. As a satellite radio broadcaster, Sirius' business depends on the lives and proper operation of its satellites. The lives of Sirius' satellites will vary and depend on a number of factors, including degradation and durability of solar panels, quality of construction, damage or destruction for a variety of reasons, and random failure of satellite components. Although Sirius' satellite system provides for backups and insurance in the event of a failure, failures and anomalies are expected to occur in the ordinary course of business and Sirius is unable to predict if any of these possible events will have a material adverse effect on its operations or the life of its existing in-orbit satellites.

Our subsidiaries and business affiliates are subject to risks of adverse government regulation. Providers of internet, telephony and satellite service are subject to varying degrees of regulation in the United States by the Federal Communications Commission (FCC) and other entities and in foreign countries by similar regulators. Such regulation and legislation are subject to the political process and have been in constant flux over the past decade. Material changes in the law and regulatory requirements must be anticipated, and there can be no assurance that our businesses and assets will not become subject to increased expenses or more stringent restrictions as a result of any future legislation, new regulation or deregulation.

10

The success of two of our business affiliates, Sirius and Live Nation, depends on audience acceptance of their programs and services, which is difficult to predict. Entertainment content production, satellite radio services and live entertainment events are inherently risky businesses because the revenue derived from these businesses depends primarily upon the public's acceptance of these programs and services, which is difficult to predict. The commercial success of a satellite radio program or live entertainment production depends upon the quality and acceptance of competing programs, the availability of alternative forms of entertainment and leisure time activities, general economic conditions and other tangible and intangible factors, many of which are difficult to predict. In the case of ad-supported programming and satellite radio service, audience size is an important factor when advertising rates are negotiated. Audience size is also an important factor when determining ticket pricing for live entertainment productions. Consequently, low public acceptance of the programs and services offered by Sirius and Live Nation, which we account for as equity affiliates, could hurt the ability of these companies to maintain rates charged to customers, subscribers and, as applicable, advertisers.

Increased programming and content costs may adversely affect profits. One of our business affiliates, Sirius, produces programming and other content and incurs costs for all types of creative talent including writers, producers and on-air talent. An increase in the costs of programming and other content may lead to decreased profitability.

Continuingly weak economic conditions may reduce consumer demand for our products and services. The current economic malaise in the United States could adversely affect demand for our products and services. A substantial portion of our revenue is derived from discretionary spending by individuals, which typically falls during times of economic instability. A reduction in discretionary spending could adversely affect revenue through potential downgrades by satellite and cable television subscribers and satellite radio subscribers, affecting Sirius, reduced live-entertainment expenditures, affecting Live Nation and ANLBC, and a slowdown in auto sales (which is an important source of satellite radio subscribers), affecting Sirius. Accordingly, our ability to increase or maintain revenue and earnings could be adversely affected to the extent that relevant economic environments remain weak or decline further. We currently are unable to predict the extent of any of these potential adverse effects.

The success of one of our subsidiaries, ANLBC, depends in large part on its ability to recruit and retain key persons. The success of ANLBC depends on the record of the Atlanta Braves Major League baseball team during each season, which is directly impacted by their ability to employ and retain top performing players, coaches and managers. We cannot assure you that if the Atlanta Braves Major League baseball team experiences turnover of these key persons, they will be able to recruit and retain acceptable replacements, in part, because the market for such employees is very competitive and limited.

The success of our business affiliate, Sirius, depends in large part upon automakers. Most of Sirius' new subscription growth has come from purchasers and lessees of new and previously owned automobiles. As a result, the sale and lease of vehicles with satellite radios is an important source of subscribers for its satellite radio service. Sirius has agreements with every major automaker to include satellite radios in new vehicles, although these agreements do not require automakers to install specific or minimum quantities of radios in any given period. Automotive production and sales are dependent on many factors, including the availability of consumer credit, general economic conditions, consumer confidence and fuel costs. To the extent vehicles sales by automakers decline or the penetration of factory-installed satellite radios in those vehicles is reduced, subscriber growth for Sirius' satellite radio services may be adversely impacted.

Several of our business affiliates face substantial competition, which may increase over time. Sirius faces substantial competition from other providers of music and talk radio and other audio services and its ability to retain and attract customers is based on its successful programming. Sirius' subscribers can obtain similar content through terrestrial radio or internet radio services, and a number of automakers

11

and aftermarket manufacturers have or will shortly introduce factory-installed radios capable of accessing internet-delivered auto entertainment. Such competition could lower subscription or other revenue or increase expenses related to marketing and promotion, which would lower Sirius' earnings and free cash flow. Similarly, Barnes & Noble faces competition from traditional and internet retail sources, as well as from other suppliers of digital content. Its retail stores compete primarily on the quality of the shopping and store experience and the price and availability of products, which take into account promotional activities. Barnes & Noble's eBook reader, the NOOK®, competes with other eBook readers and smart tablets on functionality, consumer appeal, availability of digital content and price. In addition, Barnes & Noble faces competition from large bookstores such as Books-A-Million, wholesalers such as Costco and online retailers such as Amazon.com and Apple. Increases in consumer spending online may significantly affect Barnes & Noble's ability to generate sales in its retail stores. Barnes & Noble also faces competition from a variety of sources with respect to sales of music and DVDs. Increased competition faced by our business affiliates may adversely affect their, and hence our, results of operations,

The success of three of our business affiliates, Sirius, Live Nation and Barnes & Noble, depends, in part, on the integrity of their systems and infrastructures and the protection of consumer data. The businesses of Sirius, Live Nation and Barnes & Noble involve the receipt and storage of personal information about consumers. While the receipt and storage of such information is subject to regulation by international, federal and state law, and although Sirius, Live Nation and Barnes & Noble may take steps to protect personal information, these companies could experience a data security breach, which could result in a disruption of operations and potential violations of applicable privacy laws and other laws or standards which could result in fines, penalties and/or the loss of consumer trust.

We do not have the right to manage our business affiliates, which means we are not able to cause those affiliates to operate in a manner that is favorable to us. We do not have the right to manage the businesses or affairs of any of our business affiliates (those companies in which we have less than a majority voting stake), including Sirius, Live Nation and Barnes & Noble. Rather, our rights take the form of representation on the board of directors and, in some cases, board committees that supervise management and possession of veto rights over certain significant or extraordinary actions. The scope of our veto rights varies from company to company. Although our board representation and veto rights may enable us to exercise influence over the management or policies of a business affiliate, enable us to prevent the sale of material assets by a business affiliate or prevent a business affiliate from paying dividends or making distributions to its stockholders or partners, they will not enable us to cause these actions to be taken.

Our acquisition of voting control of Sirius remains subject to FCC approval. Liberty Media has submitted to the FCC an application for the transfer to it of de jure control over Sirius (the Application). The Application has not yet been approved, and no assurance can be given that it will be approved. In the Application, Liberty Media represented to the FCC that it would not convert enough shares of preferred stock of Sirius to become the owner of more than 50% of the outstanding common stock of Sirius prior to obtaining FCC approval of the Application. In addition, Liberty Media represented in the Application that, if it does receive FCC approval, it would thereafter convert enough shares of preferred stock and/or acquire additional shares of common stock of Sirius in a sufficient amount to become the owner of more than 50% of the outstanding common stock of Sirius. The FCC has accepted Liberty Media's filing of the Application and placed it on public notice for comment. The public comment period has expired, and only one opposition filing was made. Although the FCC generally follows a 180 day informal timeline from public notice for considering major transfer of control transactions, which it informally has designated the Application, the FCC is not under any obligation to take action by a specific date. Additionally, the FCC may approve or deny the Application in its discretion, and, even if it approves the Application, such approval could be granted subject to conditions that could adversely affect the manner in which Sirius operates its business in the future. In

12

the event the FCC does not approve the Application, we would be unable to convert all of our preferred stock or otherwise obtain majority voting control of Sirius. In such a case, we may be unable to fully realize the anticipated benefits of our 49.8% beneficial ownership interest in Sirius common stock in the near term or at all.

Our equity method investments may have a material impact on our net earnings. We have substantial investments in Sirius and Live Nation, which we account for under the equity method of accounting. Under the equity method, we report our proportionate share of the net earnings or losses of our equity affiliates in our statement of operations under "share of earnings (losses) of affiliates," which contributes to our earnings (loss) from continuing operations before income taxes. If the earnings or losses of our equity affiliates is material in any year, those earnings or losses may have a material effect on our net earnings. Notwithstanding the impact on our net earnings, we do not have the ability to cause our equity affiliates to pay dividends or make other payments or advances to their stockholders, including us. In addition, our investments in Sirius and Live Nation are in publicly traded securities which are not reflected at fair value on our balance sheet and are also subject to market risk that is not directly reflected in our statement of operations.

The liquidity and value of our public investments may be affected by market conditions beyond our control that could cause us to record losses for declines in their market value. Included among our assets are equity interests in one or more publicly-traded companies that are not consolidated subsidiaries or equity affiliates, such as Time Warner Inc., Time Warner Cable Inc. and Sprint Nextel Corporation. The value of these interests may be affected by economic and market conditions that are beyond our control. In addition, our ability to liquidate these interests without adversely affecting their value may be limited.

Transactions in our common stock by our insiders could depress the market price of our common stock. Sales of or hedging transactions, such as collars, in our shares by our Chairman of the Board or any of our other directors or executive officers could cause a perception in the marketplace that our stock price has peaked or that adverse events or trends have occurred or may be occurring at our company. This perception could result notwithstanding any personal financial motivation for these insider transactions. As a result, insider transactions could depress the market price for shares of one or more series of our common stock.

No assurance can be made that we will be successful in integrating any acquired businesses. Our businesses and those of our subsidiaries may grow through acquisitions in selected markets. Integration of new businesses may present significant challenges, including: realizing economies of scale in programming and network operations; eliminating duplicative overhead; and integrating networks, financial systems and operational systems. No assurance can be made that, with respect to any acquisition, we will realize anticipated benefits or successfully integrate any acquired business with our existing operations. In addition, while we intend to implement appropriate controls and procedures as we integrate acquired companies, we may not be able to certify as to the effectiveness of these companies' disclosure controls and procedures or internal control over financial reporting (as required by U.S. federal securities laws and regulations) until we have fully integrated them.

Our company has overlapping directors and management with Liberty Interactive and one overlapping director with Starz, which may lead to conflicting interests. As a result of the Spin-Off and the Split-Off, most of the executive officers of Spinco also serve as executive officers of Liberty Interactive, and there is significant board overlap between our company and Liberty Interactive. Following the Spin-Off, John C. Malone will be the Chairman of the Board of our company and Liberty Interactive. Gregory B. Maffei will be the Chief Executive Officer of our company and Liberty Interactive and will serve on the boards of directors of each of our company, Liberty Interactive and Starz. None of Spinco, Starz and Liberty Interactive has any ownership interest in the others. Our executive officers and members of our company's board of directors have fiduciary duties to our stockholders. Likewise, any such persons who

13

serve in similar capacities at Liberty Interactive or Starz have fiduciary duties to that company's stockholders. Therefore, such persons may have conflicts of interest or the appearance of conflicts of interest with respect to matters involving or affecting more than one of the companies to which they owe fiduciary duties. For example, there may be the potential for a conflict of interest when Spinco or Liberty Interactive looks at acquisitions and other corporate opportunities that may be suitable for each of them. Moreover, most of our company's directors and officers continue to own Starz and Liberty Interactive stock and options to purchase Starz stock and Liberty Interactive stock. These ownership interests could create, or appear to create, potential conflicts of interest when the applicable individuals are faced with decisions that could have different implications for our company, Starz and/or Liberty Interactive. Any potential conflict that qualifies as a "related party transaction" (as defined in Item 404 of Regulation S-K) is subject to review by an independent committee of the applicable issuer's board of directors in accordance with its corporate governance guidelines. Any other potential conflicts that arise will be addressed on a case-by-case basis, keeping in mind the applicable fiduciary duties owed by the executive officers and directors of each issuer. From time to time, we may enter into transactions with Liberty Interactive or Starz and/or their subsidiaries or other affiliates. There can be no assurance that the terms of any such transactions will be as favorable to our company, Starz, Liberty Interactive or any of their subsidiaries or affiliates as would be the case where there is no overlapping officer or director.

Holders of a single series of our common stock may not have any remedies if an action by our directors has an adverse effect on only that series of our common stock. Principles of Delaware law and the provisions of our certificate of incorporation may protect decisions of our board of directors that have a disparate impact upon holders of any single series of our common stock. Under Delaware law, the board of directors has a duty to act with due care and in the best interests of all of our stockholders, including the holders of all series of our common stock. Principles of Delaware law established in cases involving differing treatment of multiple classes or series of stock provide that a board of directors owes an equal duty to all common stockholders regardless of class or series and does not have separate or additional duties to any group of stockholders. As a result, in some circumstances, our directors may be required to make a decision that is viewed as adverse to the holders of one series of our common stock. Under the principles of Delaware law and the business judgment rule, holders may not be able to successfully challenge decisions that they believe have a disparate impact upon the holders of one series of our stock if our board of directors is disinterested and independent with respect to the action taken, is adequately informed with respect to the action taken and acts in good faith and in the honest belief that the board is acting in the best interest of all of our stockholders.

It may be difficult for a third party to acquire us, even if doing so may be beneficial to our stockholders. Certain provisions of our restated charter and bylaws may discourage, delay or prevent a change in control of our company that a stockholder may consider favorable. These provisions include:

14

In addition, our chairman, John C. Malone, is expected to beneficially own shares representing the power to direct approximately 40.5% of the aggregate voting power in our company, due to his beneficial ownership of approximately 83.8% of the outstanding shares of LMCB as of October 31, 2012.

We may have future capital needs and may not be able to obtain additional financing on acceptable terms. In connection with the Spin-Off, it is expected that Starz, LLC will distribute approximately $1.8 billion in cash to Liberty Media, of which $400 million was distributed in the third quarter of 2012 (and $200 million of which was distributed thereafter). The total amount of the distribution will depend upon the financial performance and cash position of Starz, LLC prior to the Spin-Off. This distributed cash, as reduced by investments of such cash prior to the Spin-Off, will be contributed to Spinco in connection with the Spin-Off. Due to the size and nature of our consolidated subsidiaries, ANLBC and TruePosition, their assets and operating cash flow are insufficient to support any significant financing in the future. Hence, our ability to obtain significant financing in the future, on favorable terms or at all, may be limited. If debt financing is not available to us in the future, we may obtain liquidity through the sale or monetization of our available for sale securities, or we may issue equity securities. If additional funds are raised through the issuance of equity securities, our stockholders may experience significant dilution. If we are unable to obtain sufficient liquidity in the future, we may be unable to develop our businesses properly, complete acquisitions or otherwise take advantage of business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our business, financial condition and results of operations.

Our consolidated subsidiary TruePosition is out of contract with one of its largest customers. Our subsidiary TruePosition provides equipment and service for locating mobile phones and other wireless devices enabling carriers, application providers and other enterprises to provide E-911 services domestically and other location based services to mobile users. The contract with one of its largest customers, T-Mobile, lapsed in mid-2011. This resulted in TruePosition's recognition of $491 million of deferred revenue in the fourth quarter of 2011, representing substantially all of the revenue earned from T-Mobile since the inception of the contract. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Businesses—Revenue." No assurance can be given that TruePosition will be able to negotiate a new contract with T-Mobile on favorable terms or at all. TruePosition's inability to enter into a new contract on economically acceptable terms could have a material adverse effect on the business, financial condition and results of operations of TruePosition and an adverse effect on our consolidated financial results.

Factors Relating to the Spin-Off

The Spin-Off could result in a significant tax liability. Liberty Media has requested the Ruling from the IRS to the effect that, among other things, the Spin-Off will qualify as a tax-free transaction for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code. It is a condition to the Spin-Off that the Ruling is obtained and that it is not thereafter withdrawn, invalidated or modified in an adverse manner. Although any Ruling that is obtained will generally be binding on the IRS, the continued validity of the Ruling will be subject to the accuracy of factual statements and

15

representations made to the IRS by Liberty Media. Further, as a result of the IRS's general ruling policy with respect to transactions under Section 355 of the Code, the Ruling will not represent a determination by the IRS that certain requirements necessary to obtain tax-free treatment to holders of Liberty Media common stock and to Liberty Media under Sections 355 and 368(a)(1)(D) of the Code (specifically, the corporate business purpose requirement, the requirement that the Spin-Off not be used principally as a device for the distribution of earnings and profits, and the non-application of Section 355(e) of the Code to the Spin-Off (discussed below)) have been satisfied. Rather, the Ruling will be based upon representations made to the IRS by Liberty Media that these requirements have been satisfied.

As a result of this IRS ruling policy, the Spin-Off is also conditioned upon the receipt by Liberty Media of the opinion of Skadden, in form and substance reasonably acceptable to Liberty Media, to the effect that the Spin-Off will qualify as a tax-free transaction to Liberty Media and to the holders of Liberty Media common stock for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code. The opinion of counsel will rely on the continued validity of the Ruling, as to the matters covered by the Ruling, and will be based upon certain assumptions, as well as statements, representations and certain undertakings made by officers of Liberty Media and Spinco and Chairman John C. Malone. These assumptions, statements, representations and undertakings are expected to relate to, among other things, Liberty Media's/Starz's business reasons for engaging in the Spin-Off and Liberty Media's/Starz's and Spinco's current plans and intentions to continue conducting certain of its business activities and not to materially modify its ownership or capital structure, in each case following the Spin-Off. If the Ruling is no longer valid, if any of those statements, representations or assumptions is incorrect or untrue in any material respect or any of those undertakings is not complied with, or if the facts upon which the opinion is based are materially different from the facts at the time of the Spin-Off, the conclusions reached in such opinion could be adversely affected. Opinions of counsel are not binding on the IRS or the courts, and the conclusions expressed in such opinion could be challenged by the IRS and a court could sustain such challenge. These conditions, as well as all other conditions to the Spin-Off, may be waived by the Liberty Media board of directors in its sole discretion.

Even if the Spin-Off otherwise qualifies under Sections 355 and 368(a)(1)(D) of the Code, the Spin-Off would result in a significant U.S. federal income tax liability to Liberty Media (but not to holders of Liberty Media common stock) under Section 355(e) of the Code if one or more persons acquire a 50-percent or greater interest (measured by vote or value) in the stock of Liberty Media/Starz or in the stock of Spinco as part of a plan or series of related transactions that includes the Spin-Off. Current tax law generally creates a presumption that any acquisition of the stock of Liberty Media/Starz or the stock of Spinco within two years before or after the Spin-Off is part of a plan that includes the Spin-Off, although the parties may be able to rebut that presumption. The process for determining whether an acquisition is part of a plan under these rules is complex, inherently factual and subject to an analysis of the facts and circumstances of a particular case. Notwithstanding the opinion of counsel described above, Starz or Spinco might inadvertently cause or permit a prohibited change in Starz's ownership or Spinco's ownership to occur, thereby triggering tax liability to Starz, which could have a material adverse effect.

If it is subsequently determined, for whatever reason, that the Spin-Off does not qualify for tax-free treatment, Liberty Media and/or the holders of Liberty Media common stock immediately prior to the Spin-Off could incur significant tax liabilities determined in the manner described in "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off." As described further under "Certain Relationships and Related Party Transactions—Relationships between Spinco and Liberty Media/Starz and/or Liberty Interactive—Tax Sharing Agreement," in certain circumstances, Spinco will be required to indemnify Starz, its subsidiaries, and certain related persons for taxes and losses resulting from the Spin-Off. For a more complete discussion of the Ruling, the tax opinion and the tax

16

consequences if the Spin-Off is not tax-free, please see "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Spin-Off."

Spinco may have a significant indemnity obligation to Starz, which is not limited in amount or subject to any cap, if the Spin-Off is treated as a taxable transaction. Pursuant to the tax sharing agreement that Spinco will enter into with Liberty Media in connection with the Spin-Off (the tax sharing agreement), subject to certain limited exceptions, Spinco will be required to indemnify Starz, its subsidiaries, and certain related persons for taxes and losses resulting from the failure of the Spin-Off to qualify as a tax-free transaction described under Sections 355 and 368(a)(1)(D) of the Code. However, Spinco will not be required to indemnify Starz for any taxes or losses that (x) result primarily from, individually or in the aggregate, the breach of certain covenants made by Starz (applicable to actions or failures to act by Starz and its subsidiaries following the completion of the Spin-Off), (y) result from Section 355(e) of the Code applying to the Spin-Off as a result of the Spin-Off being part of a plan (or series of related transactions) pursuant to which one or more persons acquire a 50-percent or greater interest (measured by vote or value) in the stock of Liberty Media/Starz or any successor, or (z) result from deferred intercompany items or excess loss accounts that are triggered by the Spin-Off, and that would otherwise be allocated to Starz.

Spinco's indemnification obligations to Starz, its subsidiaries and certain related persons will not be limited in amount or subject to any cap. If Spinco is required to indemnify Starz, its subsidiaries and certain related persons under the circumstances set forth in the tax sharing agreement, Spinco may be subject to substantial liabilities, which could materially adversely affect its financial position.

Spinco may determine to forgo certain transactions in order to avoid the risk of incurring significant tax-related liabilities. In the tax sharing agreement, Spinco will covenant not to take any action, or fail to take any action, following the Spin-Off, which action or failure to act is inconsistent with the Spin-Off qualifying for tax-free treatment under Sections 355 and 368(a)(1)(D) of the Code. Further, the tax sharing agreement will require that Spinco generally indemnify Starz for any taxes or losses incurred by Starz (or its subsidiaries) resulting from breaches of such covenants or resulting from Section 355(e) of the Code applying to the Spin-Off because of acquisitions of a 50-percent or greater interest (measured by vote or value) in the stock of Spinco that are part of a plan that includes the Spin-Off. As a result, Spinco might determine to forgo certain transactions that might have otherwise been advantageous in order to preserve the tax-free treatment of the Spin-Off.

In particular, Spinco might determine to continue to operate certain of its business operations for the foreseeable future even if a sale or discontinuance of such business might have otherwise been advantageous. Moreover, in light of the requirements of Section 355(e) of the Code, Spinco might determine to forgo certain transactions, including share repurchases, stock issuances, certain asset dispositions or other strategic transactions for some period of time following the Spin-Off. In addition, Spinco's indemnity obligation under the tax sharing agreement might discourage, delay or prevent a change of control transaction for some period of time following the Spin-Off.

We may not realize the potential benefits from the Spin-Off in the near term or at all. In this information statement, we have described anticipated strategic and financial benefits we expect to realize as a result of our separation from Liberty Media. See "The Spin-Off—Reasons for the Spin-Off." In particular, we believe that the Spin-Off will better position us to take advantage of business opportunities, strategic alliances and other acquisitions through Spinco's enhanced acquisition currency and greater liquidity. We also expect the Spin-Off to enable Spinco to provide its employees with more attractive equity incentive awards. However, no assurance can be given that the market will react favorably to the Spin-Off or that the current holding company discount applied by the market to Liberty Media's stock will not be applied in full to Spinco's common stock, thereby causing Spinco's equity to be less attractive to its employees as well as any potential acquisition counterparties. In addition, no assurance can be given that any investment, acquisition or other strategic opportunities will

17

become available following the Spin-Off on terms that Spinco finds favorable or at all. Given the added costs associated with the completion of the Spin-Off, including the separate accounting, legal and other compliance costs of being a separate public company and potential tax liabilities, our failure to realize the anticipated benefits of the Spin-Off in the near term or at all could adversely affect our company.

We cannot be certain that an active trading market will develop or be sustained after the Spin-Off, and following the Spin-Off our stock price may fluctuate significantly. We cannot assure you that an active trading market will develop or be sustained for our common stock after the Spin-Off. We cannot predict the prices at which either series of our common stock may trade after the Spin-Off, the effect of the Spin-Off on the trading prices of Starz's common stock or whether the market value of a share of a series of our common stock and a share of the same series of Starz's common stock held by a stockholder after the Spin-Off will be less than, equal to or greater than the market value of a share of the corresponding series of Liberty Media common stock held by such stockholder prior to the Spin-Off.

The market price of our common stock may fluctuate significantly due to a number of factors, some of which may be beyond our control, including:

The fair value of Liberty Media's investment in Sirius, on an as-converted basis, was approximately $8.2 billion as of September 30, 2012, which represents a large portion of Liberty Media's total market value and will represent an even larger portion of Spinco's total market value following the Spin-Off. Liberty Media's common stock has historically traded at times somewhat in tandem with Sirius common stock. As a result of the Spin-Off, our stock price may move in tandem with the Sirius stock price to a greater degree than Liberty Media's common stock does today, with the result that our stock price may be disproportionately affected by the results of operations of Sirius and developments in its business.

After the Spin-Off, Spinco may be controlled by one principal stockholder. John C. Malone currently beneficially owns shares of Liberty Media common stock (excluding exercisable stock options) representing approximately 40.5% of the aggregate voting power of the outstanding shares of Liberty Media's common stock as of October 31, 2012. Following the consummation of the Spin-Off, Mr. Malone is expected to beneficially own shares of our common stock (excluding exercisable stock options) representing approximately 40.5% of Spinco's voting power, based upon the 1-for-1 distribution ratio in the Spin-Off and his beneficial ownership of Liberty Media common stock as of October 31, 2012 (as reflected under "Security Ownership of Certain Beneficial Owners—Security Ownership of Management" below). By virtue of Mr. Malone's voting power in Spinco as well as his position as Spinco's Chairman of the Board, Mr. Malone may be deemed to control Spinco's operations. Mr. Malone's rights to vote or dispose of his equity interest in Spinco will not be subject to any restrictions in favor of Spinco other than as may be required by applicable law and except for customary transfer restrictions pursuant to incentive award agreements.

Liberty Media's board of directors may abandon the Spin-Off at any time, and our board of directors may determine to amend the terms of any agreement we enter into relating to the Spin-Off. No assurance can be given that the Spin-Off will occur, or if it occurs that it will occur on the terms described in this information statement. In addition to the conditions to the Spin-Off described herein (all of which may be waived by the Liberty Media board of directors in its sole discretion), the Liberty Media board of directors may abandon the Spin-Off at any time prior to the distribution date for any reason or for no reason. In addition, the agreements to be entered into by Spinco in connection with the Spin-Off

18

(including the reorganization agreement, the tax sharing agreement, the services agreement and the facilities sharing agreement) may be amended or modified prior to the distribution date in the sole discretion of Liberty Media. If any condition to the Spin-Off is waived or if any material amendments or modifications are made to the terms of the Spin-Off or to such ancillary agreements prior to the Spin-Off, Liberty Media intends to promptly issue a press release and file a Form 8-K informing the market of the substance of such waiver, amendment or modification.

19

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS

Certain statements in this information statement and in the documents incorporated by reference herein constitute forward-looking statements, including certain statements relating to the business strategies, market potential and future financial performance of our company and those entities in which we have interests, and other matters. In particular, information included under "The Spin-Off," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Description of our Business" contain forward-looking statements. Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but such statements necessarily involve risks and uncertainties and there can be no assurance that the expectation or belief will result or be achieved or accomplished. In addition to the risk factors described herein under the headings "Risk Factors," the following include some but not all of the factors that could cause actual results or events to differ materially from those anticipated:

These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this information statement, and we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein or therein, to

20

reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based. When considering such forward-looking statements, you should keep in mind the factors described in "Risk Factors" and other cautionary statements contained or incorporated in this document. Such risk factors and statements describe circumstances which could cause actual results to differ materially from those contained in any forward-looking statement.

21

Our company is currently a wholly owned subsidiary of Liberty Media. Following the Spin-Off, we will be primarily engaged in the media, communications and entertainment industries through our ownership of interests in subsidiaries and other companies. Following the Spin-Off, our principal businesses and assets will include the consolidated subsidiaries Atlanta National League Baseball Club, Inc. (the owner of the Atlanta Braves major league baseball team) and TruePosition, Inc., the equity affiliates Sirius XM Radio Inc. and Live Nation Entertainment, Inc., and minority investments in public companies such as Barnes & Noble, Inc., Time Warner Inc., Time Warner Cable Inc., Viacom Inc. and Sprint Nextel Corporation, and cash in the amount of $[ ], which will include cash contributed from Liberty Media to Spinco prior to the Spin-Off following Starz LLC's draw down on its $1.5 billion credit facility (such businesses and assets as well as any related liabilities, the Spin-Off Assets and Liabilities).

The businesses and assets that remain at Starz following the Spin-Off will consist of the premium movie service provider Starz, LLC and its subsidiaries.

The board of directors of Liberty Media has determined to separate the Spin-Off Assets and Liabilities from the assets and liabilities of Starz, LLC and its subsidiaries by means of the Spin-Off. To accomplish the Spin-Off, Liberty Media will effect the distribution, whereby holders of LMCA and LMCB will receive, by means of a dividend, shares of our Series A common stock and Series B common stock, respectively. Following the Spin-Off, Starz will cease to own any equity interest in our company, and we will be an independent publicly traded company. No vote of Liberty Media's stockholders is required or being sought in connection with the Spin-Off, and Liberty Media's stockholders have no appraisal rights in connection with the Spin-Off.

The board of directors of Liberty Media periodically reviews with management the strategic goals and prospects of its various businesses, equity affiliates and other investments. As a result of a review undertaken during the summer of 2012 the Liberty Media board determined that the Spin-Off would allow each of Starz and Spinco to pursue strategic opportunities that are not otherwise available to them in Liberty Media's current configuration and, over time, enhance the operating performance of the two companies. Among the factors considered by the Liberty Media board in arriving at its determination were the following:

22

Liberty Media's board also considered a number of costs and risks associated with the Spin-Off, including:

Based on pro forma information, Liberty Media's board also considered the percentage of revenue, total assets and total liabilities of Liberty Media attributable to the businesses and liabilities that will (i)

23

be transferred to Spinco in connection with the Spin-Off and (ii) remain with Starz, which as of September 30, 2012, December 31, 2011 and December 31, 2010 were as follows:

| |

Revenue | Total Assets | Total Liabilities | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

September 30, 2012 |

||||||||||

Spinco |

21 | % | 73 | % | 58 | % | ||||

Starz |

79 | % | 27 | % | 42 | % | ||||

December 31, 2011 |

||||||||||

Spinco |

47 | % | 67 | % | 60 | % | ||||

Starz |

53 | % | 33 | % | 40 | % | ||||

December 31, 2010 |

||||||||||

Spinco |

21 | % | 83 | % | 94 | % | ||||

Starz |

79 | % | 17 | % | 6 | % | ||||

Liberty Media's board evaluated the costs and benefits of the transaction as a whole and did not find it necessary to assign relative weights to the specific factors considered. Liberty Media's board concluded, however, that the potential benefits of the Spin-Off outweighed its potential costs, and that separating our company from Liberty Media in the form of a distribution to Liberty Media's stockholders that is generally tax-free is appropriate, advisable and in the best interests of Liberty Media and its stockholders.

In connection with the Spin-Off, the executive officers and directors of Liberty Media will receive adjustments to their stock incentive awards with respect to Liberty Media common stock and stock incentive awards with respect to Spinco common stock. See "—Effect of the Spin-Off on Outstanding Liberty Media Incentive Awards" below for more information.

The current executive officers and directors of Liberty Media (other than Charles Y. Tanabe, who is retiring on December 31, 2012) will also serve as the executive officers and directors of Spinco immediately following the Spin-Off, and certain of these directors will also serve as directors of Starz. See "Risk Factors—Our company has overlapping directors and management with Liberty Interactive and Starz, which may lead to conflicting interests." Furthermore, the executive officers and directors of Liberty Media and Spinco are entitled to indemnification with respect to actions taken by them in connection with the Spin-Off under the organizational documents of Liberty Media and Spinco, as well as customary indemnification agreements to which Liberty Media or Spinco, on the one hand, and these persons, on the other hand, are parties.

The table below sets forth the relative dollar values of the stock ownership of each current executive officer and director of Liberty Media. The dollar values have been calculated based on security ownership information as of October 31, 2012 and the closing sale price of each series of Liberty Media common stock on December 12, 2012. On December 12, 2012, the closing price of Series A Liberty Capital common stock was $108.04 and Series B Liberty Capital common stock was $108.06. For this purpose, we have included stock owned by each such person's spouse and by certain trusts related to each such person, in each case, to the extent applicable. We have also included the executive officer's or director's shares of unvested restricted stock, however we have not included the

24

shares of common stock issuable upon exercise or conversion of their options or stock appreciation rights outstanding on October 31, 2012.

Director or Executive Officer

|

Liberty Media Common Stock Value ($) |

|||

|---|---|---|---|---|

John C. Malone |

$ | 1,099,217,220 | ||

Gregory B. Maffei |

$ | 61,371,366 | ||

Robert R. Bennett |

$ | 123,327,856 | ||

Donne F. Fisher |

$ | 6,454,204 | ||

M. Ian G. Gilchrist |

$ | 145,098 | ||

Evan D. Malone |

$ | 231,530 | ||

David E. Rapley |

$ | 378,032 | ||

Larry E. Romrell |

$ | 716,526 | ||

Andrea L. Wong |

$ | 280,364 | ||

Charles Y. Tanabe |

$ | 2,794,022 | ||

Albert E. Rosenthaler |

$ | 1,783,092 | ||

Christopher W. Shean |

$ | 637,544 | ||

As of October 31, 2012, Liberty Media's executive officers and directors beneficially owned shares of Liberty Media common stock representing in the aggregate approximately 46.7% of the aggregate voting power of the outstanding shares of Liberty Media common stock.

The Liberty Media board was aware of these interests and considered them when it approved the Spin-Off.

Liberty Media's board of directors has reserved the right, in its sole discretion, to amend, modify, delay or abandon the Spin-Off and the related transactions at any time prior to the distribution date. In addition, the completion of the Spin-Off and related transactions are subject to the satisfaction (determined by the Liberty Media board of directors in its sole discretion) of the following conditions, any of which may be waived by the Liberty Media board of directors in its sole discretion:

25

In the event the Liberty Media board of directors waives a material condition to the Spin-Off, Liberty Media intends to promptly issue a press release and file a Current Report on Form 8-K to report such event.

Manner of Effecting the Spin-Off

Liberty Media is effecting the Spin-Off by distributing to its stockholders as a dividend (i) one share of our Series A common stock for each whole share of LMCA and (ii) one share of our Series B common stock for each whole share of LMCB, in each case, held by such stockholder as of the record date.

Following the record date and prior to the distribution date, Liberty Media will deliver all of the issued and outstanding shares of our Series A common stock and Series B common stock to the distribution agent. If you own Liberty Media common stock as of the close of business on the record date, the shares of Spinco common stock that you are entitled to receive in the Spin-Off will be issued electronically, as of the distribution date, to you or to your bank or brokerage firm on your behalf by way of direct registration in book-entry form, which we expect to occur within one (1) business day of the distribution date to allow the distribution agent to effect the distribution of shares. Registration in book-entry form refers to a method of recording stock ownership when no physical share certificates are issued to stockholders, as is the case in the Spin-Off. Please note that if any stockholder of Liberty Media sells shares of LMCA or LMCB before the record date, so that such stockholder is not the record holder on the record date, the buyer of those shares, and not the seller, will become entitled to receive the shares of our common stock issuable in respect of the shares sold. If you are a holder of shares of Liberty Media common stock on the record date, you will be entitled to receive the shares of Spinco common stock issuable in respect of those shares sold even if you sell them between the record date and the distribution date. See "—Trading Prior to the Record Date" below for more information. At such time, pursuant to the reorganization agreement to be entered into between Spinco and Liberty Media, Spinco will be spun off from Liberty Media and will become an independent publicly traded company.

Stockholders of Liberty Media are not being asked to take any action in connection with the Spin-Off. No stockholder approval of the Spin-Off is required or being sought. Neither Liberty Media nor our company is asking you for a proxy, and you are requested not to send us a proxy. You are not required to pay any consideration or give up any portion of your Liberty Media common stock to receive shares of our common stock in the Spin-Off.

Effect of the Spin-Off on Outstanding Liberty Media Incentive Awards

Options to purchase shares of Liberty Media common stock, stock appreciation rights with respect to shares of Liberty Media common stock and restricted shares of Liberty Media common stock have been granted to various directors, officers, employees and consultants of Liberty Media and certain of its subsidiaries pursuant to the various stock incentive plans administered by the Liberty Media board of directors or the compensation committee thereof. Below is a description of the effect of the Spin-Off on these outstanding equity awards.

Option Awards

Except as described below with respect to certain unvested options, the holder of an outstanding option to purchase shares of Liberty Media common stock on the record date (an original Liberty Media option) will receive an option to purchase an equivalent number of shares of the corresponding

26

series of our common stock (a new Spinco option) and an adjustment to the exercise price of the original Liberty Media option (as so adjusted, an adjusted Starz option). The exercise prices of the new Spinco option and the related adjusted Starz option will be determined based upon the exercise price of the original Liberty Media option, the pre-Spin-Off trading price of Liberty Media common stock (determined using the volume weighted average price of Liberty Media common stock over the three-consecutive trading days immediately preceding the Spin-Off) and the relative post-Spin-Off trading prices of Starz's common stock and Spinco common stock (determined using the volume weighted average price of the applicable series of common stock over the three-consecutive trading days beginning on the first trading day following the Spin-Off on which both Starz's common stock and the Spinco common stock trade in the "regular way" (meaning once the common stock trades using a standard settlement cycle)), such that the pre-Spin-Off intrinsic value of the original Liberty Media option is allocated between the new Spinco option award and the adjusted Starz option.

The holder of any unvested original Liberty Media option who is a current or former direct employee or consultant of Starz, LLC or any of its subsidiaries will not receive any new Spinco options as a result of the distribution. Rather, his or her unvested original Liberty Media option will instead be adjusted so as to preserve the pre-Spin-Off intrinsic value of the unvested original Liberty Media option based upon the exercise price of and number of shares subject to such original Liberty Media option and the pre-Spin-Off trading price of the Liberty Media common stock and post-Spin-Off trading prices of Starz's common stock (in each case, determined as described above). It was determined that these original Liberty Media option holders would not receive new Spinco options, as their future performance will have no impact on the financial results of the businesses of Spinco following the Spin-Off. Further, this adjustment-only approach was not applied to vested awards so as to avoid depriving the holders of such vested awards of the ability to exercise their awards promptly following the distribution.

Except as described above, all other terms of an adjusted Starz option and a new Spinco option (including, for example, the vesting terms thereof) will, in all material respects, be the same as those of the corresponding original Liberty Media option. The terms of the adjusted Starz option will be determined and the new Spinco option will be granted as soon as practicable following the determination of the pre- and post-Spin-Off trading prices of Liberty Media/Starz common stock and Spinco common stock, as applicable.

SAR Awards

Except as described below with respect to certain unvested stock appreciation rights, the holder of an outstanding stock appreciation right with respect to shares of Liberty Media common stock on the record date (an original Liberty Media SAR) will receive a stock appreciation right with respect to an equivalent number of shares of the corresponding series of our common stock (a new Spinco SAR) and an adjustment to the base price of the original Liberty Media SAR (as so adjusted, an adjusted Starz SAR). The base prices of the new Spinco SAR and the related adjusted Starz SAR will be determined based upon the base price of the original Liberty Media SAR, the pre-Spin-Off trading price of Liberty Media common stock (determined using the volume weighted average price of Liberty Media common stock over the three-consecutive trading days immediately preceding the Spin-Off) and the relative post-Spin-Off trading prices of Starz's common stock and Spinco common stock (determined using the volume weighted average price of the applicable series of common stock over the three-consecutive trading days beginning on the first trading day following the Spin-Off on which both Starz's common stock and the Spinco common stock trade in the regular way), such that the pre-Spin-Off intrinsic value of the original Liberty Media SAR is allocated between the new Spinco SAR and the adjusted Starz SAR.

The holder of any unvested original Liberty Media SAR who is a current or former direct employee or consultant of Starz, LLC or any of its subsidiaries will not receive any new Spinco SARs

27

as a result of the distribution. Rather, his or her unvested original Liberty Media SAR will instead be adjusted so as to preserve the pre-Spin-Off intrinsic value of the unvested original Liberty Media SAR based upon the base price of and number of shares subject to such original Liberty Media SAR and the pre-Spin-Off trading price of the Liberty Media common stock and post-Spin-Off trading prices of Starz's common stock (in each case, determined as described above). It was determined that these original Liberty Media SAR holders would not receive new Spinco SARs, as their future performance will have no impact on the financial results of the businesses of Spinco following the Spin-Off. Further, this adjustment-only approach was not applied to vested awards so as to avoid depriving the holders of such vested awards of the ability to exercise their awards promptly following the distribution.