Use these links to rapidly review the document

TABLE OF CONTENTS Prospectus Supplement

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-215858

The information in this prospectus supplement and the accompanying base prospectus is not complete and may be changed. This prospectus supplement and the accompanying base prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement dated May 16, 2017

PROSPECTUS SUPPLEMENT

(To prospectus dated May 16, 2017)

Liberty Media Corporation

Up to $1,175,000,000 of

Series C Liberty Formula One Common Stock

Liberty Media Corporation ("Liberty Media") is offering up to a maximum aggregate amount of $400,000,000 of shares of Liberty Media Series C Liberty Formula One common stock, par value $0.01 per share ("FWONK"). Additionally, the selling stockholders identified in this prospectus supplement (the "Selling Stockholders") are selling up to a maximum aggregate amount of $775,000,000 of shares of FWONK. At an assumed public offering price of $32.95 per share, the closing price of shares of FWONK on the NASDAQ Global Select Market (the "Nasdaq") on May 15, 2017, we would expect to issue and sell 12,139,605 shares of FWONK and we would expect the Selling Stockholders to sell 23,520,485 shares of FWONK. The underwriters have agreed to sell shares of FWONK on behalf of Liberty Media and the Selling Stockholders at a price of $ per share, which will result in approximately $ million of aggregate net proceeds to Liberty Media and approximately $ million of aggregate net proceeds to the Selling Stockholders, in each case after deducting underwriting discounts and commissions but before deducting expenses. Liberty Media will not receive any proceeds from the sale of shares of FWONK by the Selling Stockholders in this offering.

Shares of FWONK are currently listed on the Nasdaq under the symbol "FWONK." On May 15, 2017, the last sale price of shares of FWONK as reported on Nasdaq was $32.95 per share.

Investing in these securities involves risks. You should carefully consider the matters described under the caption "Risk Factors" beginning on page S-11 of this prospectus supplement and on page 17 of the accompanying base prospectus.

|

Per share | Total |

|||

| | | | | | |

Public Offering Price |

$ | $ | |||

Underwriting Discount |

$ | $ | |||

Proceeds, before expenses, to Liberty Media |

$ | $ | |||

Proceeds, before expenses, to Selling Stockholders |

$ | $ |

Liberty Media and the Selling Stockholders have granted the underwriters an option exercisable for a period of 30 days from the date of this prospectus supplement to purchase up to an additional maximum aggregate amount of $176,250,000 of shares of FWONK, consisting of an additional maximum aggregate amount of $60,000,000 of shares of FWONK to be offered by Liberty Media and an additional maximum aggregate amount of $116,250,000 of shares of FWONK to be offered by the Selling Stockholders (provided that, if the option is not exercised in full by the underwriters, the Selling Stockholders' shares of FWONK will have priority).

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of FWONK are expected to be made on or about , 2017.

| Goldman Sachs & Co. LLC | J.P. Morgan | Morgan Stanley |

| BofA Merrill Lynch | Barclays | Credit Suisse |

The date of this prospectus supplement is , 2017.

TABLE OF CONTENTS

Prospectus Supplement

You should rely only on the information we have provided or incorporated by reference in this prospectus supplement, the accompanying base prospectus or any related free writing prospectus we prepare or authorize. Neither we nor the Selling Stockholders have authorized any person to provide you with additional or different information. We take no responsibility for, and can provide no assurance to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying base prospectus are an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any related free writing prospectus is accurate as of any date other than the dates shown in such documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of shares of FWONK by Liberty Media and the Selling Stockholders and also adds, updates and changes information contained in the accompanying base prospectus and the documents incorporated herein by reference. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of shares of FWONK. Generally, when we refer only to the "prospectus," we are referring to both this prospectus supplement and the accompanying base prospectus combined. If the information relating to the offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Where To Find More Information" on page S-37 of this prospectus supplement.

Liberty Media and the Selling Stockholders are offering to sell, and seeking offers to buy, shares of FWONK only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying base prospectus and the offering of shares of FWONK in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying base prospectus must inform themselves about, and observe any restrictions relating to, the offering of shares of FWONK by Liberty Media and the Selling Stockholders and the distribution of this prospectus.

None of Liberty Media, the Selling Stockholders, the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in shares of FWONK by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in shares of FWONK.

Market and industry data and forecasts used in this prospectus supplement have been obtained from independent industry sources as well as from research reports prepared for other purposes. Although we believe these third-party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus supplement.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus supplement, the accompanying base prospectus, any supplements to this prospectus supplement and the accompanying base prospectus and other documents that are and will be incorporated into this prospectus supplement and the accompanying base prospectus constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our business, product and marketing strategies; new service offerings; revenue growth and subscriber trends at Sirius XM (as defined herein); the recoverability of our goodwill and other long-lived assets; the

S-ii

performance of our equity affiliates; our projected sources and uses of cash; Sirius XM's stock repurchase program; the anticipated non-material impact of certain contingent liabilities related to legal and tax proceedings; the integration of Delta Topco (as defined herein) and by extension Formula 1 (as defined herein) and other matters arising in the ordinary course of business. In particular, statements under "Risk Factors" contain forward-looking statements. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. The following include some but not all of the factors (as they relate to our consolidated subsidiaries and equity affiliates) that could cause actual results or events to differ materially from those anticipated:

S-iii

For additional risk factors, please see "Risk Factors" below and in the accompanying base prospectus, Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this prospectus supplement and we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based.

When considering such forward-looking statements, you should keep in mind the factors described in "Risk Factors" and other cautionary statements contained in this prospectus supplement and the accompanying base prospectus and in the documents incorporated by reference herein and therein. Such risk factors and statements describe circumstances which could cause actual results to differ materially from those contained in any forward-looking statement.

S-iv

The following summary highlights selected information included or incorporated by reference in this prospectus to help you understand our Company, shares of FWONK and this offering. This summary is not complete and does not contain all the information you should consider before investing in shares of FWONK. For a more complete understanding of our Company, shares of FWONK and this offering, we encourage you to read this entire document, including the accompanying base prospectus, and the information incorporated by reference herein, including the financial statements of the Company and the notes thereto. All references to the "Company," "Liberty Media," "we," "our" and "us" and words of similar effect refer to Liberty Media Corporation, and, unless the context otherwise requires, its consolidated subsidiaries.

Our Capital Structure

Under our current amended and restated certificate of incorporation (our "current charter"), our common stock is comprised of three tracking stocks, with each tracking stock divided into three series. Our tracking stocks, which are designated the Liberty SiriusXM common stock, the Liberty Braves common stock and the Liberty Formula One common stock, are intended to track and reflect the separate economic performance of the businesses, assets and liabilities attributed to the SiriusXM Group, the Braves Group and the Formula One Group, respectively. While each group has a separate collection of businesses, assets and liabilities attributed to it, none of these groups is a separate legal entity and therefore cannot own assets, issue securities or enter into legally binding agreements. Hence, holders of our Liberty SiriusXM common stock, Liberty Braves common stock and Liberty Formula One common stock have no direct claim to the relevant group's assets, and are not represented by a separate board of directors. Instead, holders of those stocks are stockholders of Liberty Media Corporation, with a single board of directors and subject to all of the risks and liabilities of Liberty Media as a whole.

At a special meeting of stockholders of the Company held on January 17, 2017, our stockholders approved the adoption of an amendment and restatement of our then-existing charter (1) to change the name of the "Media Group" to the "Formula One Group," (2) to change the name of the "Liberty Media common stock" to the "Liberty Formula One common stock," (3) to reclassify each share of each series of our then-existing Liberty Media common stock into one share of the corresponding series of Liberty Formula One common stock solely to effect the name change and (4) to make certain conforming changes (the "group name change"). The current charter was filed with the Secretary of State of the State of Delaware on January 24, 2017, and gave effect to the group name change.

The Liberty SiriusXM common stock tracks and reflects the separate economic performance of the businesses, assets and liabilities attributed to the SiriusXM Group, which includes, among other things, Liberty Media's approximate 67.5% interest in Sirius XM as of March 31, 2017. The Liberty Braves common stock tracks and reflects the separate economic performance of the businesses, assets and liabilities attributed to the Braves Group, which includes, among other things, Liberty Media's wholly owned subsidiary Braves Holdings, which indirectly owns the Atlanta Braves Major League Baseball club. The Liberty Formula One common stock, which includes FWONK, tracks and reflects the separate economic performance of the businesses, assets and liabilities attributed to the Formula One Group, which includes the remainder of Liberty Media's businesses, assets and liabilities not attributed to the SiriusXM Group or the Braves Group, including, in addition to Liberty Media's consolidated subsidiary, Formula 1 (as discussed herein), among other things, Liberty Media's approximate 34% interest in Live Nation Entertainment, Inc. ("Live Nation") as of March 31,

S-1

2017, Liberty Media's minority investments in Time Warner, Inc. ("Time Warner") and Viacom, Inc. ("Viacom"), and its 15.5% inter-group interest in the Braves Group as of March 31, 2017.

Our Business

We own controlling and non-controlling interests in a broad range of media, communications and entertainment companies. Through our subsidiaries and affiliates, we principally operate in North America. Our principal businesses and assets include our consolidated subsidiaries SIRIUS XM Holdings Inc. ("Sirius XM" or "SIRIUS XM"), Braves Holdings, LLC ("Braves Holdings") and Delta Topco Limited, the parent company of Formula 1 (as defined below) ("Delta Topco"). In addition to the foregoing businesses, we hold ownership interests in Live Nation and, through Sirius XM, SIRIUS XM Canada, and we maintain investments in "available for sale" securities and related financial instruments in public companies such as Time Warner and Viacom. Our business strategy and that of our subsidiaries and business affiliates includes selective acquisitions or other strategic initiatives focused on business expansion.

Sirius XM. Sirius XM provides a subscription based satellite radio service. Sirius XM transmits music, sports, entertainment, comedy, talk, news, traffic and weather channels, as well as infotainment services in the United States on a subscription fee basis through its two proprietary satellite radio systems — the Sirius system and the XM system. Subscribers can also receive their music and other channels, plus features such as SiriusXM On Demand and MySXM, over Sirius XM's Internet radio service, including through applications for mobile devices. Sirius XM is also a leader in providing connected vehicle services. Sirius XM's connected vehicle services are designed to enhance the safety, security and driving experience for vehicle operators while providing marketing and operational benefits to automakers and their dealers. Sirius XM has agreements with every major automaker to offer satellite radios in their vehicles from which Sirius XM acquires the majority of its subscribers. It also acquires subscribers through marketing to owners and lessees of vehicles that include factory-installed satellite radios that are not currently subscribing to Sirius XM services. Additionally, Sirius XM distributes its radios through retailers online and at locations nationwide and through its website. Satellite radio services are also offered to customers of certain rental car companies.

Our consolidated subsidiary Sirius XM is attributed to our SiriusXM Group.

Braves Holdings. Braves Holdings is our wholly owned subsidiary that indirectly owns and operates the Atlanta Braves Major League Baseball club (the "Braves") and five minor league baseball clubs (the Gwinnett Braves, the Mississippi Braves, the Rome Braves, the Danville Braves and the GCL Braves). Braves Holdings also operates a baseball academy in the Dominican Republic and leases a baseball facility from a third party in connection with its academy. Braves Holdings had exclusive operating rights to Turner Field, the home stadium of the Atlanta Braves, until December 31, 2016 pursuant to an Operating Agreement with the Atlanta Fulton County Recreation Authority. Effective for the 2017 season, the Braves relocated into a new ballpark located in Cobb County, a suburb of Atlanta. The facility is leased from Cobb County, Cobb-Marietta Coliseum and Exhibit Hall Authority and will offer a range of activities and eateries for fans. Braves Holdings and its affiliates participated in the construction of the new stadium and are participating in the construction of an adjacent mixed-use development project, which we refer to as the Development Project.

Our wholly owned subsidiary Braves Holdings is attributed to our Braves Group.

Formula 1. As discussed further in the accompanying base prospectus under "The Company — Description of the Formula 1 Acquisition," on January 23, 2017 we acquired 100% of the fully diluted equity interests of Delta Topco (the "Formula 1 Acquisition"), the parent company

S-2

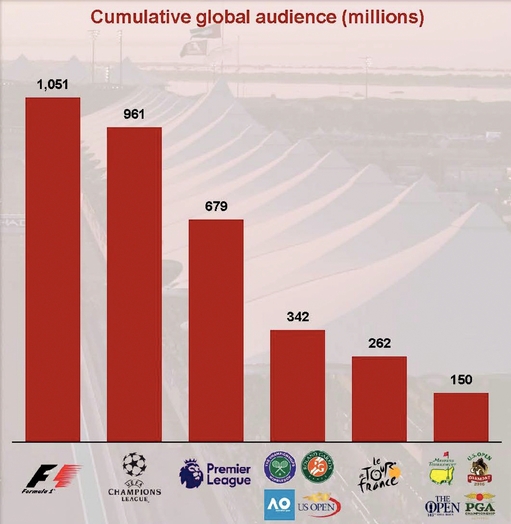

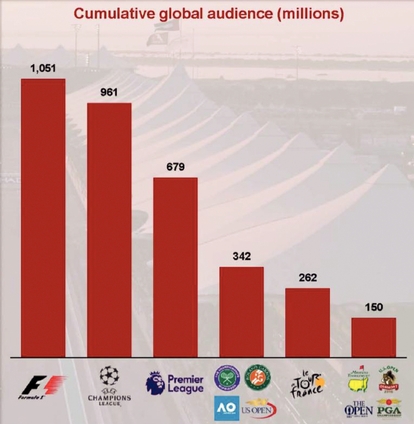

of the group of companies that exploit exclusive commercial rights pertaining to the Fédération Internationale de l'Automobile ("FIA") Formula One World Championship® (the "World Championship") (such companies, together with Delta Topco, "Formula 1"), other than a nominal number of equity securities held by the Teams (as defined below). The World Championship is an annual, approximately nine-month long, motor race-based competition in which teams (the "Teams") compete for the Constructors' Championship and drivers compete for the Drivers' Championship. The World Championship is a global series with a varying number of events ("Events") taking place in different countries around the world each season. During 2016, 21 Events took place in 21 countries across Europe, Asia-Pacific, the Middle East and North and South America. Formula 1 is followed by hundreds of millions of television viewers in over 200 territories, and Formula 1's largest Events have hosted live audiences of up to 350,000 on race weekends, such as the British Grand Prix at the Silverstone circuit and the Mexican Grand Prix at the Autódromo Hermanos Rodríguez. We do not provide guidance on our future results of operations. There are risks and uncertainties that may affect our financial position and future results of operations, including during the implementation of the strategy described in the accompanying prospectus and in the Appendix to this prospectus supplement. See "Risk Factors" in this prospectus supplement as well as those risks described in the information included or incorporated by reference, including the risk factors described in Item 1A ("Risk Factors") of Part I of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed with the Securities and Exchange Commission on February 28, 2017, together with the matters addressed in the sections of this prospectus supplement and the accompanying base prospectus entitled "Cautionary Note Regarding Forward-Looking Statements." For additional information about Formula 1, please see "The Company — Description of the Business of Formula 1" in the accompanying base prospectus and "Appendix: Business and Financial Information of Formula 1" to this prospectus supplement.

Our consolidated subsidiary Delta Topco is attributed to our Formula One Group.

Live Nation. We beneficially owned approximately 34% of the issued and outstanding shares of Live Nation common stock as of March 31, 2017. Live Nation is considered the world's largest live entertainment company and seeks to innovate and enhance the live entertainment experience for artists and fans before, during and after the show. Live Nation has four business segments: concerts; sponsorship and advertising; ticketing and artist nation.

Our equity affiliate Live Nation is attributed to our Formula One Group.

Time Warner. As of March 31, 2017, we beneficially owned 4,252,831 shares of Time Warner common stock, representing less than 1% of the outstanding common stock of Time Warner. Of the shares we beneficially own, 464,323 have been pledged as collateral to secure obligations of certain subsidiaries of Braves Holdings pursuant to credit facilities entered into by those subsidiaries to fund certain costs of the Development Project.

Our shares of Time Warner common stock are attributed to our Formula One Group.

Corporate Information

Our principal executive offices are located at 12300 Liberty Boulevard, Englewood, Colorado 80112. Our main telephone number is (720) 875-5400. Our website is available at http://www.libertymedia.com. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus supplement.

S-3

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying base prospectus. For a more detailed description of shares of FWONK, see the description of our capital stock contained in Amendment No. 1 to our Form 8-A filed on January 24, 2017 and our current charter, and any amendment or report filed for the purpose of updating such description, which has been incorporated by reference into the accompanying base prospectus.

Shares offered by Liberty Media |

Up to a maximum aggregate amount of $400,000,000 of shares of FWONK (not including any shares of FWONK that may be purchased by the underwriters pursuant to the underwriters' option to purchase additional shares of FWONK). | |

Shares offered by the Selling Stockholders |

Up to a maximum aggregate amount of $775,000,000 of shares of FWONK (not including any shares of FWONK that may be purchased by the underwriters pursuant to the underwriters' option to purchase additional shares of FWONK). |

|

Option to purchase additional Shares of FWONK |

We and the Selling Stockholders have granted the underwriters an option exercisable for a period of 30 days from the date of this prospectus supplement to purchase up to an additional maximum aggregate amount of $176,250,000 of shares of FWONK, consisting of an additional maximum aggregate amount of $60,000,000 of shares of FWONK to be offered by Liberty Media and an additional maximum aggregate amount of $116,250,000 of shares of FWONK to be offered by the Selling Stockholders (provided that, if the option is not exercised in full by the underwriters, the Selling Stockholders' shares of FWONK will have priority). |

|

Shares of FWONK outstanding before this offering |

173,916,106 shares. |

|

Shares of FWONK outstanding after this offering |

shares (assuming the exercise in full of the underwriters' option to purchase additional shares). |

|

Voting rights |

Holders of shares of FWONK have no voting rights, except as required by Delaware law. |

S-4

Use of proceeds |

We expect to receive net proceeds of approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional shares of FWONK in full), after deducting underwriting discounts and commissions and offering expenses, from our sale of the shares of FWONK in this offering. Following the closing of this offering, we intend to use the net proceeds from this offering to repay existing indebtedness of a wholly owned subsidiary of Delta Topco and pay expenses related to the offering. |

|

|

We will not receive any proceeds from the sale of shares of FWONK by the Selling Stockholders in this offering. One of the Selling Stockholders is an affiliate of one of the underwriters in this offering and will receive proceeds from this offering in an amount that is equal to less than five percent of the aggregate proceeds of this offering. |

|

|

See "Use of Proceeds" on page S-14 of this prospectus supplement for additional information. |

|

Risk factors |

You should carefully consider the information set forth in the section entitled "Risk Factors" in this prospectus supplement and the accompanying base prospectus and the other information included or incorporated by reference into this prospectus supplement and the accompanying base prospectus in deciding whether to purchase shares of FWONK. |

|

Nasdaq trading symbol |

Shares of FWONK are listed on Nasdaq under the symbol "FWONK." |

|

Dividends |

We have not paid any cash dividends on our Series C Liberty Formula One common stock, and we have no present intention of paying cash dividends on our Series C Liberty Formula One common stock in the future. See "Price Range of Our Series C Liberty Formula One Common Stock — Dividend Policy" on page S-18 of this prospectus supplement. |

The number of shares offered by Liberty Media and by the Selling Stockholders, or by any one Selling Stockholder, may be increased or decreased depending upon various factors, including market conditions.

S-5

SELECTED CONSOLIDATED HISTORICAL FINANCIAL DATA OF LIBERTY MEDIA

The following tables set forth our historical balance sheet data as of March 31, 2017 and December 31, 2016, 2015, 2014, 2013 and 2012, and our historical statement of operations for the three months ended March 31, 2017 and 2016 and for each of the years in the five-year period ended December 31, 2016. The following information is qualified in its entirety by, and should be read in conjunction with, our audited financial statements and notes thereto for the periods presented that are included in our Annual Report on Form 10-K for the year ended December 31, 2016, which is incorporated by reference herein. See "Where To Find More Information."

|

December 31, |

||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

March 31, 2017(1) |

2016 | 2015 | 2014 | 2013 | 2012 |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

amounts in millions | ||||||||||||||||||

Cash |

$ | 1,071 | 562 | 201 | 681 | 1,088 | 603 | ||||||||||||

Investments in available-for-sale securities and other cost investments(4)(8) |

$ | 582 | 1,309 | 533 | 816 | 1,324 | 1,392 | ||||||||||||

Investment in affiliates, accounted for using the equity method(2)(3)(4) |

$ | 1,101 | 1,117 | 1,115 | 851 | 3,299 | 3,341 | ||||||||||||

Intangible assets not subject to amortization |

$ | 27,986 | 24,018 | 24,018 | 24,018 | 24,018 | 344 | ||||||||||||

Intangible assets subject to amortization, net |

$ | 6,467 | 1,072 | 1,097 | 1,166 | 1,200 | 108 | ||||||||||||

Assets of discontinued operations(5) |

$ | — | — | — | — | — | 2,099 | ||||||||||||

Total assets |

$ | 41,002 | 31,377 | 29,798 | 30,269 | 33,632 | 8,299 | ||||||||||||

Current portion of deferred revenue |

$ | 2,466 | 1,877 | 1,797 | 1,641 | 1,575 | 24 | ||||||||||||

Long-term debt, including current portion |

$ | 13,354 | 8,018 | 6,881 | 5,845 | 5,561 | — | ||||||||||||

Deferred tax liabilities, net |

$ | 2,646 | 2,025 | 1,667 | 1,507 | 1,396 | 804 | ||||||||||||

Stockholders' equity |

$ | 14,980 | 11,756 | 10,933 | 11,398 | 14,081 | 6,440 | ||||||||||||

Noncontrolling interest(2) |

$ | 5,796 | 5,960 | 7,198 | 8,778 | 9,801 | (8 | ) | |||||||||||

S-6

Summary Statement of Operations Data

|

Three months ended |

|||||||||||||||||||||

|

March 31, | Years ended December 31, |

||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

|

2017(1) | 2016 | 2016 | 2015 | 2014 | 2013(2) | 2012 |

|||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

|

amounts in millions, except per share amounts | |||||||||||||||||||||

Revenue(2) |

$ | 1,395 | 1,204 | 5,276 | 4,795 | 4,450 | 4,002 | 368 | ||||||||||||||

Operating income (loss) |

$ | 259 | 781 | 1,734 | 954 | 841 | 814 | (80 | ) | |||||||||||||

Interest expense |

$ | (140 | ) | (84 | ) | (362 | ) | (328 | ) | (255 | ) | (132 | ) | (7 | ) | |||||||

Share of earnings (loss) of affiliates, net(2)(3) |

$ | (4 | ) | (12 | ) | 14 | (40 | ) | (113 | ) | (32 | ) | 1,346 | |||||||||

Realized and unrealized gains (losses) on financial instruments, net |

$ | (12 | ) | (8 | ) | 37 | (140 | ) | 38 | 295 | 230 | |||||||||||

Gains (losses) on transactions, net(2) |

$ | — | — | — | (4 | ) | — | 7,978 | 22 | |||||||||||||

Net earnings (loss) attributable to the noncontrolling interests |

$ | 65 | 63 | 244 | 184 | 217 | 211 | (2 | ) | |||||||||||||

Earnings (loss) from continuing operations attributable to Liberty Media Corporation stockholders(7): |

||||||||||||||||||||||

Liberty Media Corporation common stock |

$ | N/A | 364 | 377 | 64 | 178 | 8,780 | 1,160 | ||||||||||||||

Liberty SiriusXM common stock |

124 | N/A | 297 | N/A | N/A | N/A | N/A | |||||||||||||||

Liberty Braves common stock |

(49 | ) | N/A | (30 | ) | N/A | N/A | N/A | N/A | |||||||||||||

Liberty Formula One common stock |

(96 | ) | N/A | 36 | N/A | N/A | N/A | N/A | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

|

$ | (21 | ) | 364 | 680 | 64 | 178 | 8,780 | 1,160 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) from continuing operations attributable to Liberty Media Corporation stockholders per common share(6)(7) : |

||||||||||||||||||||||

Series A, B and C Liberty Media Corporation common stock |

$ | N/A | 1.09 | 1.13 | 0.19 | 0.52 | 24.73 | 3.21 | ||||||||||||||

Series A, B and C Liberty SiriusXM common stock |

0.37 | N/A | 0.89 | N/A | N/A | N/A | N/A | |||||||||||||||

Series A, B and C Liberty Braves common stock |

(1.00 | ) | N/A | (0.65 | ) | N/A | N/A | N/A | N/A | |||||||||||||

Series A, B and C Liberty Formula One common stock |

(0.55 | ) | N/A | 0.43 | N/A | N/A | N/A | N/A | ||||||||||||||

Diluted earnings (loss) from continuing operations attributable to Liberty Media Corporation stockholders per common share(6)(7): |

||||||||||||||||||||||

Series A, B and C Liberty Media Corporation common stock |

$ | N/A | 1.08 | 1.12 | 0.19 | 0.52 | 24.46 | 3.12 | ||||||||||||||

Series A, B and C Liberty SiriusXM common stock |

0.37 | N/A | 0.88 | N/A | N/A | N/A | N/A | |||||||||||||||

Series A, B and C Liberty Braves common stock |

(1.00 | ) | N/A | (0.65 | ) | N/A | N/A | N/A | N/A | |||||||||||||

Series A, B and C Liberty Formula One common stock |

(0.55 | ) | N/A | 0.42 | N/A | N/A | N/A | N/A | ||||||||||||||

S-7

interest. The gain on the transaction was excluded from taxable income. Net gains and losses on transactions are included in the Other, net line item in the accompanying Liberty Media consolidated financial statements for the years ended December 31, 2016, 2015 and 2014.

Following the creation of the tracking stocks, Series A, Series B and Series C Liberty SiriusXM common stock trade under the symbols LSXMA/B/K, respectively; Series A, Series B and Series C Liberty Braves common stock trade or are quoted under the symbols BATRA/B/K respectively; and Series A, Series B and Series C Liberty Media common stock traded or were quoted under the symbols LMCA/B/K, respectively. Shortly following the Second Closing, the Media Group and Liberty Media common stock were renamed the Formula One Group (the "Formula One Group") and the Liberty Formula One common stock, respectively, and the corresponding ticker symbols for the Series A, Series B and Series C Liberty Media common stock were changed to FWONA/B/K, respectively. Each series (Series A, Series B and Series C) of the Liberty SiriusXM common stock trades on the Nasdaq Global Select Market. Series A and Series C Liberty Braves common stock trade on the Nasdaq Global Select Stock Market, and Series B Liberty Braves common stock is quoted on the OTC Markets. Series A and Series C Liberty Formula One common stock continue to trade on the Nasdaq Global Select Market, and the Series B Liberty Formula One common stock continues to be quoted on the OTC Markets.

S-8

S-9

SELECTED CONSOLIDATED HISTORICAL FINANCIAL DATA OF DELTA TOPCO

The following tables present Delta Topco selected consolidated financial statement information for the periods indicated and has been derived from Delta Topco's consolidated financial statements prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board. The financial data for the years ended December 31, 2016 and 2015 has been derived from Delta Topco's audited consolidated financial statements for that period included elsewhere in this registration statement. Data for the year ended December 31, 2014 has been derived from unaudited information. The data should be read in conjunction with Delta Topco's consolidated financial statements and "Appendix: Business and Financial Information of Formula 1 — Management's Discussion and Analysis of Financial Condition and Results of Operations for the Years Ended December 31, 2016, 2015 and 2014" included herein.

|

December 31, |

|||||||||

| | | | | | | | | | | |

|

2016 | 2015 | 2014 |

|||||||

| | | | | | | | | | | |

|

(unaudited) | |||||||||

|

amounts in millions | |||||||||

Cash |

$ | 624 | 452 | 424 | ||||||

Intangible assets not subject to amortization |

$ | 4,039 | 4,039 | 4,039 | ||||||

Intangible assets subject to amortization, net |

$ | 149 | 165 | 181 | ||||||

Deferred tax assets, net |

$ | — | 6 | 6 | ||||||

Total assets |

$ | 5,586 | 5,396 | 5,463 | ||||||

Current portion of deferred revenue |

$ | 271 | 219 | 214 | ||||||

Long-term debt, including the current portion and shareholder loan notes |

$ | 9,007 | 8,483 | 8,091 | ||||||

Deferred tax liabilities, net |

$ | 1 | — | — | ||||||

Stockholders' equity |

$ | (4,220 | ) | (3,812 | ) | (3,285 | ) | |||

|

Years ended December 31, |

|||||||||

| | | | | | | | | | | |

|

2016 | 2015 | 2014 |

|||||||

| | | | | | | | | | | |

|

(unaudited) | |||||||||

|

amounts in millions | |||||||||

Revenue |

$ | 1,796 | 1,697 | 1,702 | ||||||

Operating income (loss) |

$ | 299 | 317 | 354 | ||||||

Interest expense and other financing costs |

$ | (707 | ) | (675 | ) | (750 | ) | |||

Net earnings (loss) attributable to owners |

$ | (411 | ) | (363 | ) | (399 | ) | |||

S-10

An investment in shares of FWONK involves risk. Before investing in shares of FWONK, in addition to the other information incorporated by reference or included in this prospectus supplement and the accompanying base prospectus, including the risk factors described in Item 1A ("Risk Factors") of Part I of our annual report on Form 10-K for the fiscal year ending December 31, 2016 filed with the Securities and Exchange Commission on February 28, 2017, together with the matters addressed in the sections of this prospectus supplement and the accompanying base prospectus entitled "Cautionary Note Regarding Forward-Looking Statements," you should carefully consider the following risks. The occurrence of any of the events described as possible risks below and in the documents incorporated by reference could have a material adverse effect on the value of our common stock, including shares of FWONK. These risks are not the only ones facing our company. Additional risks not currently known to us or that we currently deem immaterial also may impair our business. See "Where to Find More Information."

Risk Factors Relating to this Offering and the Formula 1 Acquisition

Sales (or anticipated sales) of shares of FWONK that were issued in connection with the Formula 1 Acquisition or otherwise may negatively affect the trading price of shares of FWONK.

In connection with the Formula 1 Acquisition, Liberty issued an aggregate of approximately 137 million shares of FWONK at the Second Closing (as defined herein) to the Formula 1 Selling Shareholders (as defined herein), the third party investors that agreed to acquire shares that would otherwise have been issued to the Formula 1 Selling Shareholders pursuant to certain investment agreements with those third party investors, and into treasury in connection with proposed placements to Formula 1 teams. Further, Delta Topco issued $351 million in Exchangeable Notes to the Formula 1 Selling Shareholders at the Second Closing. The Exchangeable Notes, which will mature 30 months after the date of the Second Closing, will be exchangeable by the holders at any time for shares of FWONK or, at Delta Topco's option, cash. The shares of FWONK issued in connection with the Formula 1 Acquisition and issuable upon exchange of the Exchangeable Notes represent approximately 64.5% of the pro forma outstanding equity interest in the Formula One Group (based on the number of outstanding shares of Liberty Formula One common stock (of all three series) on December 31, 2016), or an estimated 152.5 million additional shares of FWONK. The approximately 19 million shares of FWONK reserved for issuance to Formula 1 teams, as described above, will be subject to purchase at a price of $21.26 per share, and will be retired six months from the date of the Second Closing if not earlier purchased.

Pursuant to the shareholders agreement (the "Shareholders Agreement") that Liberty entered into at the Second Closing with the shareholders of Formula 1 (the "Formula 1 Selling Shareholders"), Liberty filed certain shelf registration statements on Form S-3 following the Second Closing. Further, Liberty has agreed to cooperate with the Formula 1 Selling Shareholders in connection with efforts to sell their shares of FWONK in post-closing underwritten offerings under certain circumstances. Liberty has also agreed to provide registration rights to the third party investors and to cooperate with them in connection with post-closing underwritten offerings under certain circumstances. The shares of FWONK issued to the Formula 1 Selling Shareholders and third party investors will generally be eligible for resale upon the expiration of applicable lock-up periods. The Formula 1 Selling Shareholders will be generally restricted from selling shares of FWONK during the first six months following the Second Closing, with the exception of a single underwritten offering in an aggregate offering amount not to exceed $775 million (plus an additional number of shares of FWONK which may be sold upon the exercise of any customary option granted to the underwriters of such offering) at an offering price of no less than $25.00 per share. This sale of the shares offered hereby by the Selling Stockholders is being made pursuant to this

S-11

exception, and, following the completion of this offering, the Selling Stockholders will, with respect to the shares still held by them, continue to be subject to the six month lock-up period until its expiration. In addition, a limited number of management Formula 1 Selling Shareholders were granted an exception to their lock-up restrictions to enable them to sell a number of shares that would allow them to cover their tax liabilities relating to the non-cash consideration received by them at the Second Closing. This sale was completed on January 30, 2017 pursuant to a previously filed registration statement, and these management Formula 1 Selling Shareholders are now subject to the same lock-up arrangements as the other Formula 1 Selling Shareholders.

The third party investors, who collectively own 62 million shares of FWONK, are generally restricted from selling shares of FWONK during the first six months following the Second Closing or, if earlier, until the fourth week following any underwritten offering by the Formula 1 Selling Shareholders (other than the sale by the management Formula 1 Selling Shareholders completed on January 30, 2017). As a result of this offering by the Selling Stockholders, the restriction on the third party investors' ability to sell their shares will expire four weeks following the closing date of this offering.

In connection with the offering of the shares of FWONK pursuant to this prospectus supplement, we have agreed, and our directors and executive officers and the Selling Stockholders have separately agreed, to be subject to certain restrictions on our and their ability to sell shares of FWONK during the 90 days following the date of this prospectus supplement. The representatives may waive these restrictions on our ability, and the ability of our directors, executive officers and the Selling Stockholders, to sell shares of FWONK during this period in their sole discretion. For more information concerning these restrictions, see "Underwriting." Following the expiration of the 90-day lock-up period, such restrictions will terminate.

The trading price of shares of FWONK (and any other series of Liberty Formula One common stock) could decline as a result of sales of a large number of shares of FWONK in the public market, or from the perception that these sales might occur. Furthermore, sales of a substantial number of shares of Liberty Formula One common stock in the public markets, or the perception that these sales might occur, could impair our ability to raise capital through a future sale of, or pay for acquisitions using, our equity securities.

The unaudited pro forma condensed consolidated financial statements included in this prospectus supplement are presented for illustrative and informational purposes only and are not necessarily indicative of Liberty Media's future financial position or results of operations.

The unaudited pro forma condensed consolidated financial statements contained in this prospectus supplement are presented for illustrative purposes only, contain a variety of adjustments, assumptions and preliminary estimates and are not intended to represent the actual financial position or results of operations of Liberty Media had the Formula 1 Acquisition occurred on the dates indicated therein. See the sections entitled "Unaudited Pro Forma Condensed Consolidated Financial Statements" beginning on page F-71 and "Cautionary Note Regarding Forward-Looking Statements" beginning on page S-ii of this prospectus supplement. The actual financial positions and results of operations of Liberty Media and Formula 1 prior to the acquisition and that of Liberty Media following the acquisition may not be consistent with, or evident from, the unaudited pro forma condensed consolidated financial statements included in this prospectus supplement. In addition, the assumptions and preliminary estimates used in preparing the unaudited pro forma condensed consolidated financial statements included in this prospectus supplement may not be realized and may be affected by a variety of factors outside of the control of Liberty Media and Formula 1.

S-12

Formula 1 (as well as Liberty's strategic vision for it) is reliant upon the retention of certain key personnel and the hiring of strategically valuable personnel, and Formula 1 may lose or be unable to hire one or more of such personnel.

Formula 1's commercial success is dependent to a considerable extent on the abilities and reputation of Formula 1's management. In connection with the Second Closing, Liberty hired new members of management for the Formula 1 team. The recently appointed Chairman and Chief Executive Officer, Chase Carey, has a wealth of experience over many decades in the media sector. Ross Brawn and Sean Bratches have also recently joined the Formula 1 management team as Managing Directors of Motor Sports and Commercial Operations, respectively, and bring to Formula 1 valuable experience in their respective fields. Formula 1 also benefits from the long standing tenure of its Chief Financial Officer Duncan Llowarch and General Counsel Sacha Woodward Hill, each of whom has 20 plus years of experience with Formula 1. If Liberty and Formula 1 are unable to make strategic hires to strengthen the management of Formula 1, or if we are unable to retain key personnel over the long-term, Liberty may be unable to recognize the anticipated benefits of the acquisition of Formula 1.

S-13

We expect to receive net proceeds of approximately $ million from our sale of the shares of FWONK in this offering, after deducting underwriting discounts and commissions and estimated offering expenses (or approximately $ million if the underwriters' option to purchase additional shares of FWONK is exercised in full). Following the closing of this offering, we intend to use the net proceeds we receive from this offering to repay existing indebtedness of a wholly owned subsidiary of Delta Topco under its Second Lien facility (the "Second Lien Facility") and to pay expenses related to the offering. The Second Lien Facility incurs interest at a rate of LIBOR + 6.75%, subject to a LIBOR floor of 1%. The Second Lien Facility matures on July 29, 2022. The Second Lien Facility was incurred in order to pay in full private high yield loans in an aggregate amount of $1 billion incurred in October 2012 by a wholly owned subsidiary of Delta Topco and payment of related fees, costs and expenses.

The Selling Stockholders will receive all of the net proceeds from the sale of their shares of FWONK. We will not receive any proceeds from the sale of shares of FWONK by the Selling Stockholders in this offering. See "Selling Stockholders." We are, however, responsible for expenses incident to the registration under the Securities Act of 1933, as amended (the "Securities Act"), of the offer and sale of the shares of FWONK by the Selling Stockholders. One of the Selling Stockholders is an affiliate of one of the underwriters in this offering and will receive proceeds from this offering in an amount that is equal to less than five percent of the aggregate proceeds of this offering.

S-14

The following table sets forth our cash and cash equivalents and capitalization as of March 31, 2017 on a historical basis and as adjusted to give effect to the issuance and sale of shares of FWONK by Liberty Media in this offering and the application of the estimated net proceeds of this offering as described in "Use of Proceeds," as though such transactions had occurred on such date and assuming that the underwriters do not exercise their option to purchase additional shares of FWONK.

The table below should be read in conjunction with, and is qualified in its entirety by reference to, "Use of Proceeds" and the other financial information in this prospectus supplement, as well as the historical consolidated financial statements and related notes included elsewhere or incorporated by reference in this prospectus supplement.

|

As of March 31, 2017 |

||||||

| | | | | | | | |

|

Actual | As Adjusted |

|||||

| | | | | | | | |

|

(in millions) | ||||||

Cash and cash equivalents |

$ | 1,071 | 1,071 | ||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Long-term debt |

|||||||

Liberty SiriusXM Group |

|||||||

Corporate level notes and loans: |

|||||||

Margin Loans |

$ | 250 | 250 | ||||

Subsidiary notes and loans: |

|||||||

Sirius XM Senior Notes |

5,463 | 5,463 | |||||

Sirius XM Credit Facility |

530 | 530 | |||||

Sirius XM leases |

11 | 11 | |||||

Less deferred financing costs |

(7 | ) | (7 | ) | |||

| | | | | | | | |

Total Liberty SiriusXM Group |

6,247 | 6,247 | |||||

| | | | | | | | |

Liberty Braves Group |

|||||||

Subsidiary notes and loans: |

|||||||

Notes and loans |

420 | 420 | |||||

Less deferred financing costs |

(10 | ) | (10 | ) | |||

| | | | | | | | |

Total Liberty Braves Group |

410 | 410 | |||||

| | | | | | | | |

Liberty Formula One Group |

|||||||

Corporate level notes and loans: |

|||||||

Liberty 1.375% Cash Convertible Notes due 2023 |

1,132 | 1,132 | |||||

1% Cash Convertible Notes due 2023 |

494 | 494 | |||||

2.25% Exchangeable Senior Debentures due 2046 |

481 | 481 | |||||

Live Nation Margin Loan |

350 | 350 | |||||

Other |

35 | 35 | |||||

Subsidiary notes and loans: |

|||||||

Formula 1 debt |

4,221 | ||||||

Less deferred financing costs |

(16 | ) | (16 | ) | |||

| | | | | | | | |

Total Liberty Formula One Group |

6,697 | ||||||

| | | | | | | | |

Total long-term debt |

$ | 13,354 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Stockholders' equity |

|||||||

Preferred stock |

$ | — | — | ||||

Series A Liberty SiriusXM common stock |

1 | 1 | |||||

Series A Liberty Braves common stock |

— | — | |||||

Series A Liberty Formula One common stock |

— | — | |||||

Series B Liberty SiriusXM common stock |

— | — | |||||

Series B Liberty Braves common stock |

— | — | |||||

Series B Liberty Formula One common stock |

— | — | |||||

Series C Liberty SiriusXM common stock |

2 | 2 | |||||

Series C Liberty Braves common stock |

— | — | |||||

Series C Liberty Formula One common stock |

2 | 2 | |||||

Additional paid-in capital |

3,331 | ||||||

Accumulated other comprehensive earnings (loss), net of taxes |

(62 | ) | (62 | ) | |||

Retained earnings |

11,706 | 11,706 | |||||

| | | | | | | | |

Total stockholders' equity |

$ | 14,980 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total capitalization |

$ | 29,405 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

S-15

PRICE RANGE OF OUR SERIES C LIBERTY FORMULA ONE COMMON STOCK

Market Information

On July 23, 2014, holders of Series A and Series B Liberty Media Corporation common stock of as of 5:00 p.m., New York City time, on July 7, 2014, the record date for the dividend, received a dividend of two shares of Series C Liberty Media Corporation common stock for each share of Series A or Series B Liberty Media Corporation common stock held by them as of the record date. The impact of the Series C Liberty Media Corporation common stock issuance has been reflected retroactively due to the treatment of the dividend as a stock split for accounting purposes.

On November 4, 2014, Liberty Media completed the spin-off to its stockholders of common stock of a newly formed company called Liberty Broadband Corporation ("Liberty Broadband") (the "Broadband Spin-Off"). Shares of Liberty Broadband were distributed to the shareholders of Liberty as of a record date of October 29, 2014. At the time of the Broadband Spin-Off, Liberty Broadband was comprised of, among other things, (a) Liberty Media's former interest in Charter Communications, Inc. ("Charter"), (b) Liberty Media's former subsidiary TruePosition, Inc. ("TruePosition") (now known as Skyhook Holding, Inc. ("Skyhook")), (iii) Liberty Media's former minority equity investment in Time Warner Cable, Inc. ("Time Warner Cable"), (iv) certain deferred tax liabilities, as well as liabilities related to Time Warner Cable call options and (v) initial indebtedness, pursuant to margin loans entered into prior to the completion of the Broadband Spin-Off. In the Broadband Spin-Off, record holders of Series A, Series B and Series C Liberty Media Corporation common stock received one share of the corresponding series of Liberty Broadband common stock for every four shares of Liberty Media Corporation common stock held by them as of the record date for the Broadband Spin-Off, with cash paid in lieu of fractional shares.

During November 2015, Liberty Media's board of directors authorized management to pursue a recapitalization of the Company's common stock into three new tracking stock groups, one to be designated as the Liberty Braves common stock, one to be designated as the Liberty Media common stock and one to be designated as the Liberty SiriusXM common stock (the "Recapitalization"), and to cause to be distributed subscription rights related to the Liberty Braves common stock following the creation of the new tracking stocks. The Recapitalization was completed on April 15, 2016 and the newly issued shares commenced trading or quotation in the regular way on the Nasdaq Global Select Market or the OTC Markets, as applicable, on Monday, April 18, 2016. In the Recapitalization, each issued and outstanding share of Liberty Media Corporation common stock was reclassified and exchanged for (a) 1 share of the corresponding series of Liberty SiriusXM common stock, (b) 0.1 of a share of the corresponding series of Liberty Braves common stock and (c) 0.25 of a share of the corresponding series of Liberty Media common stock on April 15, 2016. Cash was paid in lieu of the issuance of any fractional shares.

Following the creation of the tracking stocks, Series A, Series B and Series C Liberty SiriusXM common stock trade under the symbols LSXMA/B/K, respectively; Series A, Series B and Series C Liberty Braves common stock trade or are quoted under the symbols BATRA/B/K respectively; and Series A, Series B and Series C Liberty Media common stock traded or were quoted under the symbols LMCA/B/K, respectively. Shortly following the closing of the acquisition of Formula 1 on January 23, 2017 (the "Second Closing"), what was formerly referred to as the Media Group and the Liberty Media common stock were renamed the Formula One Group (the "Formula One Group") and the Liberty Formula One common stock, respectively, and the corresponding ticker symbols for the Series A, Series B and Series C Liberty Media common stock were changed to FWONA/B/K, respectively. Each series (Series A, Series B and Series C) of the Liberty SiriusXM common stock trades on the Nasdaq Global Select Market. Series A and Series C Liberty Braves common stock trade on the Nasdaq Global Select Stock Market, and Series B Liberty Braves common stock is quoted on the OTC Markets. Series A and Series C Liberty Formula One common

S-16

stock continue to trade on the Nasdaq Global Select Market and the Series B Liberty Formula One common stock continues to be quoted on the OTC Markets. Although the Second Closing, and the corresponding tracking stock name and the ticker symbol change, were not completed until January 23 and January 24, 2017, respectively, historical information of the Media Group and Liberty Media common stock is referred to herein as the Formula One Group and Liberty Formula One common stock, respectively.

Our Series C Liberty Formula One common stock (formerly named Series C Liberty Media common stock) is listed on the Nasdaq under the symbol "FWONK." The following table sets forth, for the calendar quarters indicated, the range of high and low sales prices for FWONK as reported on the Nasdaq. The prices reflect Liberty Media's recapitalization into three tracking stock groups on April 15, 2016.

The following tables set forth the range of high and low sales prices of shares of our common stock for the years ended December 31, 2016 and 2015. Series B Liberty Braves common stock and Series B Liberty Formula One common stock are each quoted on OTC Markets, and such over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Liberty Media Corporation |

||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

Series A (LMCA) |

Series B (LMCB) |

Series C (LMCK) |

||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

High | Low | High | Low | High | Low |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

2015 |

|||||||||||||||||||

First quarter |

$ | 40.38 | 33.15 | 40.90 | 35.15 | 40.20 | 33.06 | ||||||||||||

Second quarter |

$ | 40.00 | 35.85 | 39.33 | 37.27 | 39.65 | 35.74 | ||||||||||||

Third quarter |

$ | 40.50 | 32.67 | 38.74 | 37.07 | 38.47 | 32.18 | ||||||||||||

Fourth quarter |

$ | 42.22 | 35.61 | 42.35 | 37.95 | 40.61 | 34.39 | ||||||||||||

2016 |

|||||||||||||||||||

First quarter |

$ | 38.97 | 31.18 | 43.59 | 33.78 | 38.14 | 31.06 | ||||||||||||

Second quarter (April 1 - April 15)(1) |

$ | 39.31 | 37.76 | 43.74 | 39.00 | 38.45 | 37.02 | ||||||||||||

|

SiriusXM Group |

||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

Series A (LSXMA) |

Series B (LSXMB) |

Series C (LSXMK) |

||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

High | Low | High | Low | High | Low |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

2016 |

|||||||||||||||||||

Second quarter (April 18 - June 30)(1) |

$ | 34.00 | 28.00 | 36.97 | 28.60 | 35.69 | 28.04 | ||||||||||||

Third quarter |

$ | 36.01 | 30.97 | 36.82 | 31.80 | 35.50 | 30.51 | ||||||||||||

Fourth quarter |

$ | 36.88 | 31.83 | 38.76 | 32.63 | 36.36 | 31.34 | ||||||||||||

2017 |

|||||||||||||||||||

First quarter |

$ | 40.18 | 34.04 | 41.20 | 33.82 | 39.80 | 33.62 | ||||||||||||

Second quarter (Through May 15, 2017) |

$ | 41.39 | 36.41 | 40.80 | 38.27 | 36.19 | 41.23 | ||||||||||||

S-17

|

Braves Group |

||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

Series A (BATRA) |

Series B (BATRB) |

Series C (BATRK) |

||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

High | Low | High | Low | High | Low |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

2016 |

|||||||||||||||||||

Second quarter (April 18 - June 30)(1) |

$ | 36.00 | 14.23 | 16.20 | 15.22 | 27.00 | 13.51 | ||||||||||||

Third quarter |

$ | 17.67 | 14.97 | 17.75 | 14.50 | 17.47 | 14.42 | ||||||||||||

Fourth quarter |

$ | 21.14 | 16.52 | 18.00 | 16.59 | 21.24 | 16.18 | ||||||||||||

2017 |

|||||||||||||||||||

First quarter |

$ | 24.20 | 19.30 | 21.00 | 21.00 | 23.91 | 19.30 | ||||||||||||

Second quarter (Through May 15, 2017) |

$ | 25.64 | 22.87 | 25.80 | 23.92 | 25.38 | 22.66 | ||||||||||||

|

Formula One Group |

||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

Series A (FWONA) |

Series B (FWONB) |

Series C (FWONK) |

||||||||||||||||

| | | | | | | | | | | | | | | | | | | | |

|

High | Low | High | Low | High | Low |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

2016 |

|||||||||||||||||||

Second quarter (April 18 - June 30)(1) |

$ | 27.43 | 17.72 | 19.50 | 16.51 | 28.07 | 17.47 | ||||||||||||

Third quarter |

$ | 30.11 | 18.84 | 29.03 | 18.00 | 29.65 | 18.62 | ||||||||||||

Fourth quarter |

$ | 33.28 | 26.95 | 33.32 | 26.75 | 33.15 | 26.44 | ||||||||||||

2017 |

|||||||||||||||||||

First quarter |

$ | 33.63 | 27.63 | 32.81 | 28.25 | 35.20 | 27.55 | ||||||||||||

Second quarter (Through May 15, 2017) |

$ | 34.34 | 30.48 | 34.00 | 30.60 | 35.40 | 31.82 | ||||||||||||

The last reported sale price of FWONK on the Nasdaq on May 15, 2017 was $32.95 per share.

Dividend Policy

The declaration and payment of any dividends are at the discretion of our board of directors and depends upon our earnings, financial condition and other considerations deemed relevant by our board of directors. We have not paid any cash dividends on our Series C Liberty Formula One common stock, and we have no present intention of paying cash dividends on our Series C Liberty Formula One common stock in the future.

S-18

This prospectus supplement and the accompanying base prospectus relate in part to the offer and sale by the Selling Stockholders of up to a maximum aggregate amount of $775,000,000 of shares of FWONK, which constitute shares of FWONK issued to the Selling Stockholders at the Second Closing of the Formula 1 Acquisition. The shares of FWONK offered pursuant to this prospectus supplement and the accompanying base prospectus were issued to the Selling Stockholders in transactions that were exempt from the registration requirements of the Securities Act. See "The Company — Description of the Formula 1 Acquisition" in the base prospectus for additional information regarding the Formula 1 Acquisition.

In connection with the closing of the Formula 1 Acquisition, we entered into the Shareholders Agreement with the Formula 1 Selling Shareholders. Pursuant to the Shareholders Agreement, we agreed to file the registration statement of which this prospectus supplement and the accompanying base prospectus form a part covering the resale of the shares of FWONK offered by the Selling Stockholders. See "— The Shareholders Agreement" for additional information regarding the Shareholders Agreement.

In the table below, the percentages of outstanding shares of FWONK held by each Selling Stockholder prior to this offering are based on 173,916,106 shares of FWONK issued and outstanding as of April 30, 2017. The percentages of outstanding shares of FWONK held by each Selling Stockholder after this offering are based on 187,876,652 shares of FWONK issued and outstanding as of April 30, 2017, assuming the Selling Stockholders sell $891,250,000 of shares of FWONK offered by this prospectus supplement and accounting for the sale by us of $460,000,000 of shares of FWONK offered by this prospectus supplement (which includes, in each case, the full number of additional shares as to which we and the Selling Stockholders have granted to the underwriters an option to purchase as described under "Underwriting"). The number of shares offered by Liberty Media and by the Selling Stockholders, or by any one Selling Stockholder, as presented in this section, assumes an offering price of $32.95 (rounded down to the nearest whole

S-19

share), which was the closing price of shares of FWONK on the Nasdaq on May 15, 2017, and may be increased or decreased depending upon various factors, including market conditions.

Name

|

Number of shares of FWONK beneficially owned prior to offering |

Number of shares of FWONK that may be sold in offering** |

Number of shares of FWONK beneficially owned after the offering |

Percentage of outstanding shares of FWONK prior to the offering |

Percentage of outstanding shares of FWONK after the offering |

|||||||||||

| | | | | | | | | | | | | | | | | |

Bernard Ecclestone(1) |

1,239,353 | 494,054 | 745,299 | * | * | |||||||||||

Sacha Woodward Hill(2) |

187,993 | 74,941 | 113,052 | * | * | |||||||||||

Richard Thomsen(3) |

8,200 | 3,269 | 4,931 | * | * | |||||||||||

Ian Holmes(4) |

7,879 | 3,141 | 4,738 | * | * | |||||||||||

Sir Martin Sorrell(5) |

81,899 | 32,648 | 49,251 | * | * | |||||||||||

Tracey Campbell |

10,443 | 4,163 | 6,280 | * | * | |||||||||||

David Campbell |

10,443 | 4,163 | 6,280 | * | * | |||||||||||

Judith Griggs |

228,803 | 50,000 | 178,803 | * | * | |||||||||||

Patrick McNally |

453,863 | 180,927 | 272,936 | * | * | |||||||||||

Norges Bank(6) |

6,562,535 | 2,502,566 | 4,059,969 | 3.77 | % | 2.16 | % | |||||||||

Bambino Holdings Limited(7) |

5,497,572 | 2,191,543 | 3,306,029 | 3.16 | % | 1.76 | % | |||||||||

LB I Group Inc.(8) |

8,353,876 | 3,330,175 | 5,023,701 | 4.80 | % | 2.67 | % | |||||||||

Waddell & Reed Investment Funds(9) |

13,452,039 | 5,362,499 | 8,089,540 | 7.73 | % | 4.31 | % | |||||||||

Teacher Retirement System of Texas(10) |

2,534,725 | 1,008,525 | 1,526,200 | 1.46 | % | * | ||||||||||

BlackRock Funds(11) |

2,434,070 | 970,314 | 1,463,756 | 1.40 | % | * | ||||||||||

CVC Funds(12) |

25,018,130 | 9,973,186 | 15,044,944 | 14.39 | % | 8.01 | % | |||||||||

SCG Equities I Holding Corporation(13) |

2,163,475 | 862,444 | 1,301,031 | 1.24 | % | * | ||||||||||

| | | | | | | | | | | | | | | | | |

Total |

68,245,298 | 27,048,558 | 41,196,740 | 39.24 | % | 21.93 | % | |||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

S-20

S-21

The Formula 1 Acquisition

The shares of FWONK to which this prospectus supplement and accompanying base prospectus relate are comprised in part of shares of FWONK issued to the Selling Stockholders in the Formula 1 Acquisition. Such shares of FWONK constituted a portion of the purchase price payable to the Formula 1 Selling Shareholders in exchange for 100% of the fully-diluted equity interests in Delta Topco (other than a nominal number of equity securities held by the Teams).

See "The Company — Description of the Formula 1 Acquisition" in the base prospectus and "Appendix: Business and Financial Information of Formula 1" to this prospectus supplement for additional information.

The Shareholders Agreement

In connection with the closing of the Formula 1 Acquisition, we entered into the Shareholders Agreement. Pursuant to the Shareholders Agreement, we agreed to file, as soon as reasonably practicable on or following the date of the Second Closing, a shelf registration statement on Form S-3 with the SEC with respect to the registration under the Securities Act of shares of FWONK comprised of (i) all shares of FWONK issued to the Formula 1 Selling Shareholders at the Second Closing of the Formula 1 Acquisition and (ii) approximately 15.7 million shares of FWONK, equaling the maximum number of shares of FWONK issuable upon the exchange of the Exchangeable Notes issued to the Formula 1 Selling Shareholders (the "Transaction Shelf Registration Statement"). Additionally, under the Shareholders Agreement, any Formula 1 Selling Shareholder party thereto is entitled to five demand registrations and unlimited piggyback registration rights to sell all or a portion of the shares held by such Formula 1 Selling Shareholder that are issued pursuant to the Second SPA or issued in exchange for Exchangeable Notes and that have not been transferred ("registrable securities") pursuant to a registration statement filed by Liberty Media. The aggregate market value of registrable securities that are the subject of a demand registration request, as measured by the market price on the date of such demand registration request, must be at least $100 million and Liberty Media will not be obligated to effect more than one demand registration statement in any 90-day calendar period. If a demand registration is an underwritten public offering (subject to certain exceptions), CVC, as shareholder representative, will select the managing underwriters and counsel for such offering, subject to the approval of Liberty Media (such approval not to be unreasonably withheld).

On January 23, 2017, CVC, as the shareholder representative, executed a waiver relating to the Shareholders Agreement pursuant to which Liberty Media agreed to file a registration statement and related base prospectus and accompanying base prospectus supplement relating to (a) the offer and sale from time to time by certain of the Selling Stockholders who are members of Delta Topco management of up to 2,547,788 shares of FWONK to enable them to sell a number of shares that would allow them to cover their tax liabilities relating to the non-cash consideration received by them at the Second Closing and (b) the offer and sale from time to time by the Formula 1 Selling Shareholders of any remaining shares of FWONK covered by the Transaction Shelf Registration Statement. On January 30, 2017, certain of the Selling Stockholders who are members of Delta Topco management completed the sale of 1,323,421 shares of FWONK pursuant to the waiver relating to the transactions described in clause (a) above.

The Shareholders Agreement also includes provisions regarding our and the Selling Stockholders' mutual indemnification rights and obligations relating to the registration of the Selling Stockholders' shares of FWONK. Under the Shareholders Agreement, we agreed to indemnify and hold harmless each Selling Stockholder named in this prospectus supplement to the fullest extent lawful against damages, directly or indirectly caused by, relating to, arising out of, based upon or in connection with any untrue statement of material fact (or alleged untrue statement of material fact) in this prospectus supplement and accompanying base prospectus, or any amendment or

S-22

supplement hereto or thereto, or any omission or alleged omission to state a material fact required to be stated in this prospectus supplement and accompanying base prospectus, or any amendment or supplement hereto or thereto, necessary to make the statements herein, in light of the circumstances under which they were made, not misleading. Our obligations to indemnify the Selling Stockholders will not extend to any damages to a Selling Stockholder directly caused by a statement or omission in this prospectus supplement and accompanying base prospectus, or any amendment or supplement hereto or thereto, made in reliance upon and in conformity with written information furnished to Liberty Media by the Selling Stockholder or on such Selling Stockholder's behalf, in either case expressly for use herein or therein, or in any amendment or supplement hereto or thereto, relating to the Selling Stockholder. Similarly, under the Shareholders Agreement, the Selling Stockholders agreed to indemnify us (and our officers, directors, controlling affiliates and affiliates of the foregoing) against any and all damages to the extent directly caused by any untrue statement of material fact (or alleged untrue statement of material fact) or any omission or alleged omission to the extent such untrue statement or omission was made in reliance upon and in conformity with written information furnished to Liberty Media by the Selling Stockholder or on such Selling Stockholder's behalf, in either case expressly for use in this prospectus supplement and accompanying base prospectus, or any amendment or supplement hereto or thereto. Each Selling Stockholder's obligation to indemnify us is limited to the net proceeds received by such Selling Stockholder from the sale of registrable securities related to the matter in which damages are sought.

The foregoing description describes certain material terms of the Shareholders Agreement. This summary is not complete and it is qualified in its entirety by reference to the form of Shareholders Agreement, which is incorporated by reference as Exhibit 10.59 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2016.

Lock-Up Arrangements

The shares of FWONK issued to the Formula 1 Selling Shareholders and third party investors will generally be eligible for resale upon the expiration of applicable lock-up periods. Pursuant to the Shareholders Agreement, the Formula 1 Selling Shareholders will be generally restricted from selling shares of FWONK during the first six months following the Second Closing (the "six month lock-up period"). We have entered into a waiver to the Shareholders Agreement with CVC, as the shareholder representative, to provide for an exception during the six month lock-up period of a single underwritten offering in an aggregate offering amount not to exceed $775 million (plus an additional number of shares of FWONK which may be sold upon the exercise of any customary option granted to the underwriters of such offering) at an offering price of no less than $25.00 per share. This sale of the shares offered hereby by the Selling Stockholders is being made pursuant to this exception, and, following the completion of this offering, the Selling Stockholders will continue to be subject to the six month lock-up period until its expiration. In addition, a limited number of management Formula 1 Selling Shareholders were granted an exception to their lock-up restrictions to enable them to sell a number of shares that would allow them to cover their tax liabilities relating to the non-cash consideration received by them at the Second Closing. This sale was completed on January 30, 2017 pursuant to a previously filed registration statement, and these management Formula 1 Selling Shareholders are now subject to the same lock-up arrangements as the other Formula 1 Selling Shareholders.

The third party investors, who collectively own 62 million shares of FWONK, are generally restricted from selling shares of FWONK during the first six months following the Second Closing or, if earlier, until the fourth week following any underwritten offering by the Formula 1 Selling Shareholders (other than the sale by the management Formula 1 Selling Shareholders completed on January 30, 2017). As a result of this offering by the Selling Stockholders, the restriction on the

S-23

third party investors' ability to sell their shares will expire four weeks following the closing date of this offering.

In connection with the offering of the shares of FWONK pursuant to this prospectus supplement, we have agreed, and our directors and executive officers and the Selling Stockholders have separately agreed, to be subject to certain restrictions on our and their ability to sell shares of FWONK during the 90 days following the date of this prospectus supplement. The representatives may waive these restrictions on our ability, and the ability of our directors, executive officers and the Selling Stockholders, to sell shares of FWONK during this period in their sole discretion. For more information concerning these restrictions, see "Underwriting." Following the expiration of the 90 day lock-up period, such restrictions will terminate.

See "Risk Factors-Risk Factors Relating to this Offering and the Formula 1 Acquisition- Sales (or anticipated sales) of shares of FWONK that were issued in connection with the Formula 1 Acquisition or otherwise may negatively affect the trading price of shares of FWONK."

S-24

We and the Selling Stockholders are offering the shares of FWONK described in this prospectus supplement through a number of underwriters. Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC and Morgan Stanley & Co. LLC are acting as representatives of the underwriters. We and the Selling Stockholders have entered into an underwriting agreement with the underwriters. Subject to the terms and conditions of the underwriting agreement, we and the Selling Stockholders have severally agreed to sell to the underwriters, and each underwriter has severally agreed to purchase, at the public offering price less the underwriting discounts and commissions set forth on the cover page of this prospectus supplement, the number of shares of FWONK listed next to its name in the following table:

Name

|

Number of Shares |

|||

| | | | | |

Goldman Sachs & Co. LLC |

||||

J.P. Morgan Securities LLC |

||||

Morgan Stanley & Co. LLC |

||||

Barclays Capital Inc. |

||||

Credit Suisse Securities (USA) LLC |

||||

Merrill Lynch, Pierce, Fenner & Smith |

||||

| | | | | |

Total |

||||

| | | | | |

| | | | | |

| | | | | |

The underwriters are committed to purchase all of the shares of FWONK offered by us and the Selling Stockholders if they purchase any shares. The offering of the shares of FWONK by the underwriters is subject to receipt and acceptance and subject to the underwriters' right to reject any order in whole or in part. The underwriting agreement also provides that if an underwriter defaults, the purchase commitments of non-defaulting underwriters may also be increased or the offering may be terminated.