Exhibit 99.1

LETTER OF TRANSMITTAL

Liberty Media Corporation

Offer to Exchange Series C Liberty Formula One Common Stock and Cash for

All of the 2% Fixed Rate Unsecured Exchangeable Redeemable Loan Notes due 23 July 2019

issued by Delta Topco Limited

(the “Exchangeable Notes”)

by Liberty GR Acquisition Company Limited

Pursuant to the Prospectus dated October 27, 2017

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT, NEW YORK CITY TIME, AT THE END OF FRIDAY, NOVEMBER 24, 2017, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED BY THE OFFEROR (AS DEFINED HEREIN) (SUCH DATE, AS THE SAME MAY BE EXTENDED, THE “EXPIRATION DATE”). HOLDERS MUST VALIDLY TENDER THEIR EXCHANGEABLE NOTES PRIOR TO 12:00 MIDNIGHT, NEW YORK CITY TIME, AT THE END OF THE EXPIRATION DATE TO BE ELIGIBLE TO RECEIVE THE OFFER CONSIDERATION (AS DEFINED HEREIN). TENDERS OF EXCHANGEABLE NOTES MAY BE WITHDRAWN AT ANY TIME PRIOR TO 12:00 MIDNIGHT, NEW YORK CITY TIME, AT THE END OF THE EXPIRATION DATE.

The Exchange Agent for the Exchange Offer is:

|

By Registered or Certified Mail: |

|

By Overnight Delivery or Courier: |

|

Computershare

Attn: Voluntary Corporate Actions

P.O. Box 43011

Providence, RI 02940-3011 |

|

Computershare

Attn: Voluntary Corporate Actions

250 Royall Street, Suite V

Canton, MA 02021 |

DELIVERY OF THIS LETTER OF TRANSMITTAL (INCLUDING THE INSTRUCTIONS HEREIN,

THIS “LETTER OF TRANSMITTAL”) AND THE CERTIFICATES REPRESENTING THE EXCHANGEABLE NOTES OTHER THAN AS SET FORTH ABOVE WILL NOT

CONSTITUTE VALID DELIVERY.

1

VOLUNTARY CORPORATE ACTION COY: LMCA

This Letter of Transmittal is to be completed by a Holder (as defined below) desiring to tender Exchangeable Notes.

The method of delivery of this Letter of Transmittal, the certificates representing the Exchangeable Notes and all other required documents to Computershare Trust Company, N.A. (the “Exchange Agent”), as the exchange agent for the Exchange Offer (as defined below), is at the election and risk of Holders.

The instructions contained herein should be read carefully before tendering any Exchangeable Notes in the Exchange Offer (as defined below). Capitalized terms used herein and not defined herein shall have the meanings ascribed to them in the Prospectus dated October 27, 2017 (as the same may be amended or supplemented from time to time, the “Prospectus”) of Liberty Media Corporation, a Delaware corporation (“Liberty Media”). Except as otherwise indicated or as the context otherwise requires, all references to “dollars” and “$” in this Letter of Transmittal are to United States dollars

For a description of (i) certain procedures to be followed in order to tender Exchangeable Notes, see “The Exchange Offer—Procedures for Tendering Exchangeable Notes” in the Prospectus and the instructions to this Letter of Transmittal and (ii) the various financial regulatory provisions governing the Exchange Offer, see “Important Information” in the Prospectus.

Requests for additional copies of the Prospectus and this Letter of Transmittal may be directed to Liberty Media, at no cost, by writing or telephoning Liberty Media at the following address or phone number:

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, Colorado 80112

Telephone: (720) 875-5400

Attention: Investor Relations

In addition, if you have any questions about the Exchangeable Notes or the Exchange Offer generally, please contact Valerie Jacob or Brian Lewis at Freshfields Bruckhaus Deringer US LLP, counsel to the selling shareholders of Delta Topco in the Formula 1 Acquisition, at +1 (212) 277 4000.

This Letter of Transmittal and the Prospectus (together with this Letter of Transmittal, as amended and supplemented from time to time, the “Offer Documents”) constitute an offer (the “Exchange Offer”) by Liberty GR Acquisition Company Limited (the “Offeror”), a company incorporated in England and Wales and an indirect, wholly owned subsidiary of Liberty Media, to purchase all, but not less than all, of the outstanding Exchangeable Notes on the terms and subject to the conditions set forth in the Offer Documents. The Offeror owns 100% of the fully diluted equity interests of Delta Topco Limited, a private company limited by shares incorporated in Jersey (“Delta Topco”) and the issuer of the Exchangeable Notes, other than a nominal number of shares held by certain Formula 1 teams.

Upon the terms and subject to the conditions of the Exchange Offer, holders of Exchangeable Notes whose name appears on the registry of the Exchangeable Notes maintained by Delta Topco (each, a “Holder” and, collectively, the “Holders”) who validly tender and do not properly withdraw their Exchangeable Notes prior to 12:00 midnight, New York City time, at the end of the Expiration Date, will receive (i) a number of shares of Liberty Media’s Series C Liberty Formula One common stock, par value $0.01 per share (“FWONK”), equal to the quotient obtained by dividing the principal amount of such Exchangeable Notes by $22.323 and (ii) cash in an amount equal to all interest that would have been paid to such holder had such Exchangeable Notes been held until the maturity date of July 23, 2019, without discounting or compounding. We refer to such FWONK shares and cash to be paid in exchange for the Exchangeable Notes as the “Offer Consideration.” Fractional FWONK shares will not be paid as part of the Offer Consideration. In the event that an exchange would yield a fractional FWONK share, in lieu of such fraction the Offeror will round up to the nearest whole FWONK share.

2

VOLUNTARY CORPORATE ACTION COY: LMCA

The Offeror will accept for exchange all Exchangeable Notes validly tendered and not properly withdrawn on or prior to 12:00 midnight, New York City time, at the end of the Expiration Date, upon the terms and subject to the conditions described in the Prospectus and this Letter of Transmittal. The Offeror’s obligation to purchase Exchangeable Notes in the Exchange Offer is conditioned upon the receipt by the Exchange Agent of Exchangeable Notes, which have been validly tendered and not properly withdrawn, representing 100% of the outstanding principal amount of the Exchangeable Notes by 12:00 midnight, New York City time, at the end of the Expiration Date (the “Minimum Tender Condition”) and the other conditions described under “The Exchange Offer—Conditions of the Exchange Offer” in the Prospectus.

Because the Minimum Tender Condition requires the valid tender of all outstanding Exchangeable Notes, a Holder must tender not less than all of its Exchangeable Notes to participate in the Exchange Offer. No alternative, conditional or contingent tenders will be accepted.

The Exchangeable Notes were issued in registered form on the books of Delta Topco, and all of the outstanding Exchangeable Notes are represented by certificates in the names of the registered holders.

This Letter of Transmittal may be used by a Holder of Exchangeable Notes who desires to tender such Exchangeable Notes pursuant to the Exchange Offer. Only a Holder may tender Exchangeable Notes in the Exchange Offer. To tender in the Exchange Offer, a Holder must complete, sign and date this Letter of Transmittal, and mail or otherwise deliver this Letter of Transmittal and the certificate(s) representing the Exchangeable Notes being tendered, together with all other documents required by this Letter of Transmittal, so that they are received by the Exchange Agent before 12:00 midnight, New York City time, at the end of the Expiration Date.

If the Offeror decides not to accept some or all of your Exchangeable Notes because of the failure of any of the conditions to the Exchange Offer, including the Minimum Tender Condition, or any invalid tenders, in each case which are not, where permitted, waived, all of the Exchangeable Notes tendered in the Exchange Offer will be returned to the Holders, at the Offeror’s expense, promptly after the expiration or termination of the Exchange Offer.

The Exchange Offer is made upon the terms and subject to the conditions set forth in the Offer Documents. Holders are encouraged to review such information.

Holders who wish to tender their Exchangeable Notes must complete the box below entitled “Description of Exchangeable Notes Tendered” and sign in the box below entitled “Please Complete and Sign Below.”

NONE OF LIBERTY MEDIA, THE OFFEROR, DELTA TOPCO, THEIR RESPECTIVE DIRECTORS OR OFFICERS OR ANY OTHER PERSON IS MAKING ANY RECOMMENDATION AS TO WHETHER OR NOT YOU SHOULD PARTICPIATE IN THE EXCHANGE OFFER AND EACH IS REMAINING NEUTRAL AS TO WHETHER YOU SHOULD TENDER YOUR EXCHANGEABLE NOTES FOR THE OFFER CONSIDERATION IN THE EXCHANGE OFFER. NONE OF LIBERTY MEDIA, THE OFFEROR OR THEIR RESPECTIVE DIRECTORS OR OFFICERS HAS AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION IN CONNECTION WITH THE EXCHANGE OFFER OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THE PROSPECTUS OR THE LETTER OF TRANSMITTAL. IF ANYONE ELSE MAKES ANY RECOMMENDATION OR REPRESENTATION OR GIVES ANY SUCH INFORMATION, YOU SHOULD NOT RELY UPON THAT RECOMMENDATION, REPRESENTATION OR INFORMATION AS HAVING BEEN SO AUTHORIZED.

BECAUSE THE OFFEROR IS NOT PROVIDING FOR GUARANTEED DELIVERY PROCEDURES, A HOLDER MUST ALLOW SUFFICIENT TIME FOR THE NECESSARY TENDER PROCEDURES TO BE COMPLETED DURING THE NORMAL BUSINESS HOURS OF THE EXCHANGE AGENT PRIOR TO THE EXPIRATION DATE. TENDERS NOT COMPLETED PRIOR TO 12:00 MIDNIGHT, NEW YORK CITY TIME, AT THE END OF THE EXPIRATION DATE WILL BE DISREGARDED AND OF NO EFFECT. DO NOT SEND THIS LETTER OF TRANSMITTAL OR CERTIFICATES REPRESENTING EXCHANGEABLE NOTES TO THE OFFEROR, LIBERTY MEDIA OR DELTA TOPCO. SEND THESE DOCUMENTS ONLY TO THE EXCHANGE AGENT.

3

VOLUNTARY CORPORATE ACTION COY: LMCA

List below the Exchangeable Notes to which this Letter of Transmittal relates. If the space provided below is inadequate, list the certificate numbers and principal amounts on a separately executed schedule and affix the schedule to this Letter of Transmittal. Tenders of Exchangeable Notes will be accepted only if all of the Exchangeable Notes registered to a Holder are tendered.

4

VOLUNTARY CORPORATE ACTION COY: LMCA

|

(DESCRIPTION OF EXCHANGEABLE NOTES TENDERED)

2% Fixed Rate Unsecured Exchangeable Redeemable Loan Notes due 23 July 2019

|

|

Name(s) and Address(es) of Holder(s) (Please fill in) |

|

Certificate

Number(s) |

|

Aggregate

Principal

Amount

Represented |

|

Principal Amount

Tendered* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Because of the Minimum Tender Condition, a Holder must tender all of its Exchangeable Notes if tendering any of them.

|

The names and addresses of the Holders should be printed exactly as they appear on the certificate(s) representing the Exchangeable Notes. No alternative, conditional or contingent tenders will be accepted. If you do not wish to tender your Exchangeable Notes, you do not need to return this Letter of Transmittal or take any other action. No offer is being made to, nor will tenders of Exchangeable Notes be accepted from or on behalf of, Holders in any jurisdiction in which the making or acceptance of any offer would not be in compliance of the laws of such jurisdiction.

NOTE: SIGNATURES MUST BE PROVIDED BELOW.

PLEASE READ CAREFULLY THE ACCOMPANYING INSTRUCTIONS.

Ladies and Gentlemen:

By execution hereof, the undersigned acknowledges receipt of this Letter of Transmittal (this “Letter of Transmittal”) and the Prospectus, dated October 27, 2017 (as the same may be amended or supplemented from time to time, the “Prospectus” and together with this Letter of Transmittal, as amended and supplemented from time to time, the “Offer Documents”) of Liberty Media Corporation, a Delaware corporation (“Liberty Media”). The Offer Documents constitute an offer (the “Exchange Offer”) by Liberty GR Acquisition Company Limited (the “Offeror”), a company incorporated in England and Wales and an indirect, wholly owned subsidiary of Liberty Media, to purchase all, but not less than all, of the outstanding 2% Fixed Rate Unsecured Exchangeable Redeemable Loan Notes due 23 July 2019 (the “Exchangeable Notes”) issued by Delta Topco Limited, a private company limited by shares incorporated in Jersey (“Delta Topco”), on the terms and subject to the conditions set forth in the Offer Documents. The Offeror owns 100% of the fully diluted equity interests of Delta Topco other than a nominal number of shares held by certain Formula 1 teams.

Upon the terms and subject to the conditions of the Exchange Offer, holders of Exchangeable Notes whose name appears on the registry of the Exchangeable Notes maintained by Delta Topco (each, a “Holder” and, collectively, the “Holders”) who validly tender and do not properly withdraw their Exchangeable Notes prior to 12:00 midnight, New York City time, at the end of Friday, November 24, 2017 (such date, as the same may be extended, the “Expiration Date”), will receive (i) a number of shares of Liberty Media’s Series C Liberty Formula One common stock, par value $0.01 per share (“FWONK”), equal to the quotient obtained by dividing the principal amount of such Exchangeable Notes by $22.323 and (ii) cash in an amount equal to all interest that would have been paid to such Holder had such Exchangeable Notes been held until the maturity date of July 23, 2019, without discounting or compounding. We refer to such FWONK shares and cash to be paid in exchange for the Exchangeable Notes as the “Offer Consideration.” Fractional FWONK shares will not be paid as part of the Offer

5

VOLUNTARY CORPORATE ACTION COY: LMCA

Consideration. In the event that an exchange would yield a fractional FWONK share, in lieu of such fraction the Offeror will round up to the nearest whole FWONK share.

Upon the terms and subject to the conditions of the Exchange Offer, the undersigned hereby tenders to the Offeror all of the Exchangeable Notes registered in its name, as indicated above in the box captioned “Description of Exchangeable Notes Tendered.”

Subject to, and effective upon, the acceptance for purchase of the Exchangeable Notes tendered with this Letter of Transmittal and payment of the Offer Consideration therefor in the manner described herein, the undersigned hereby sells, assigns, transfers and delivers to, or upon the order of, the Offeror, all right, title and interest in and to such Exchangeable Notes that are being tendered hereby, waives any and all other rights with respect to such Exchangeable Notes, and releases and discharges Delta Topco, Liberty Media and the Offeror from any and all claims such Holder may now have, or may have in the future, arising out of, or related to, such Exchangeable Notes, including, without limitation, any claims arising from any existing or past defaults, or any claims that such Holder is entitled to receive additional principal, interest or other payments or distributions of any kind with respect to such Exchangeable Notes, or to participate in any redemption, repurchase or exchange of such Exchangeable Notes, but excluding any claims arising now or in the future under federal securities laws and other than pursuant to the undersigned’s rights under the express terms of the Exchange Offer.

Subject to, and effective upon, the acceptance for purchase of the Exchangeable Notes tendered with this Letter of Transmittal and payment of the Offer Consideration therefor in the manner described herein, the undersigned hereby irrevocably constitutes and appoints the Offeror as the true and lawful agent and attorney-in-fact of the undersigned with respect to the Exchangeable Notes tendered hereby, with full powers of substitution and revocation (such power of attorney being deemed to be an irrevocable power coupled with an interest), to (i) present such Exchangeable Notes (and all evidences of transfer and authenticity) for transfer of ownership on the books of Delta Topco to, or upon the order of, the Offeror, and (ii) receive all benefits and otherwise exercise all rights of beneficial ownership of such Exchangeable Notes, all in accordance with the terms and conditions of the Exchange Offer as described in the Offer Documents.

The undersigned understands and acknowledges that the Exchange Offer will expire at the Expiration Date, unless the Offeror extends or earlier terminates the Exchange Offer. The undersigned understands and acknowledges that, in order to receive the Offer Consideration for the Exchangeable Notes, the undersigned must have validly tendered (and not properly withdrawn) its Exchangeable Notes prior to 12:00 midnight, New York City time, at the end of the Expiration Date. The undersigned understands and acknowledges that the undersigned may withdraw any Exchangeable Notes tendered at any time prior to 12:00 midnight, New York City time, at the end of the Expiration Date and, if such Exchangeable Notes have not been previously accepted for purchase, following 40 business days after the commencement of the Exchange Offer. In the event of a termination of the Exchange Offer, the respective tendered Exchangeable Notes will promptly be returned to the Holder.

For a withdrawal of a tender of Exchangeable Notes to be effective, a written or email notice of withdrawal must be received by Computershare Trust Company, N.A., as the exchange agent for the Exchange Offer (the “Exchange Agent”), prior to 12:00 midnight, New York City time, at the end of the Expiration Date and, if such Exchangeable Notes have not been previously accepted for purchase, following 40 business days after the commencement of the Exchange Offer. Tenders of the Exchangeable Notes may be withdrawn by delivery of a written or email notice to the Exchange Agent, at one of its addresses listed on the last page of this Letter of Transmittal. Any such notice of withdrawal must (1) specify the name of the Holder having tendered the Exchangeable Notes to be withdrawn, (2) identify the Exchangeable Notes to be withdrawn (including the certificate number or numbers and principal amount of the Exchangeable Notes, as applicable), and (3) be signed by the Holder in the same manner as the original signature on this Letter of Transmittal by which the Exchangeable Notes were tendered.

The undersigned understands that tenders of Exchangeable Notes pursuant to the procedures described in the Offer Documents and acceptance thereof by the Offeror will constitute a binding agreement between the undersigned and the Offeror upon the terms and subject to the conditions of the Exchange Offer, which agreement shall be governed by, and construed in accordance with, the laws of the State of New York.

6

VOLUNTARY CORPORATE ACTION COY: LMCA

The undersigned hereby represents and warrants the following:

· the undersigned has full power and authority to tender, sell, assign, transfer and deliver the Exchangeable Notes; and

· when the Offeror accepts the tendered Exchangeable Notes for purchase, it will acquire good and marketable title thereto, free and clear of all charges, liens, restrictions, claims, equitable interests and encumbrances, other than the undersigned’s claims under the express terms of the Exchange Offer.

The undersigned will, upon request, execute and deliver any additional documents deemed by the Exchange Agent or the Offeror to be necessary or desirable to complete the tender, sale, assignment, transfer and delivery of the Exchangeable Notes tendered thereby.

For purposes of the Exchange Offer, the undersigned understands that the Offeror will be deemed to have accepted for purchase validly tendered Exchangeable Notes, or defectively tendered Exchangeable Notes with respect to which the Offeror has waived all defects, if, as and when the Offeror gives notice thereof to the Exchange Agent.

The undersigned understands that, except as set forth in the Offer Documents, the Offeror will not be required to accept for purchase any of the Exchangeable Notes tendered.

All authority conferred or agreed to be conferred by this Letter of Transmittal shall survive the death or incapacity of the undersigned and every obligation of the undersigned under this Letter of Transmittal shall be binding upon the undersigned’s heirs, personal representatives, executors, administrators, successors, assigns, trustees in bankruptcy and other legal representatives.

The undersigned understands that the delivery and surrender of the Exchangeable Notes is not effective, and the risk of loss of the Exchangeable Notes does not pass to the Exchange Agent, until receipt by the Exchange Agent of (1) the certificate(s) representing the tendered Exchangeable Notes, (2) a properly completed, signed and dated Letter of Transmittal and (3) all accompanying evidences of authority and any other required documents in form satisfactory to the Offeror.

7

VOLUNTARY CORPORATE ACTION COY: LMCA

|

PLEASE COMPLETE AND SIGN BELOW

(This page is to be completed and signed by all tendering Holders.)

By completing, executing and delivering this Letter of Transmittal, the undersigned hereby tenders the principal amount of the Exchangeable Notes listed in the box above labeled “Description of Exchangeable Notes Tendered” under the column heading “Principal Amount Tendered” (or, if nothing is indicated therein, with respect to the entire aggregate principal amount represented by the Exchangeable Notes described in such box).

|

|

Signature(s): |

|

|

|

(Must be signed by the Holder(s) exactly as the name(s) appear(s) on certificate(s) representing the Exchangeable Notes. If signature is by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, please set forth the full title and see Instruction 3.)

|

|

Dated: |

|

|

|

|

|

|

Name(s): |

|

|

|

|

|

|

|

|

|

|

(Please Print) |

|

|

|

|

Capacity (Full Title): |

|

|

|

|

|

|

Address: |

|

|

|

(Including Zip Code/Postcode) |

|

|

|

|

International/Area Code and Telephone Number: |

|

|

|

|

|

|

Tax Identification or Social Security Number (if applicable): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

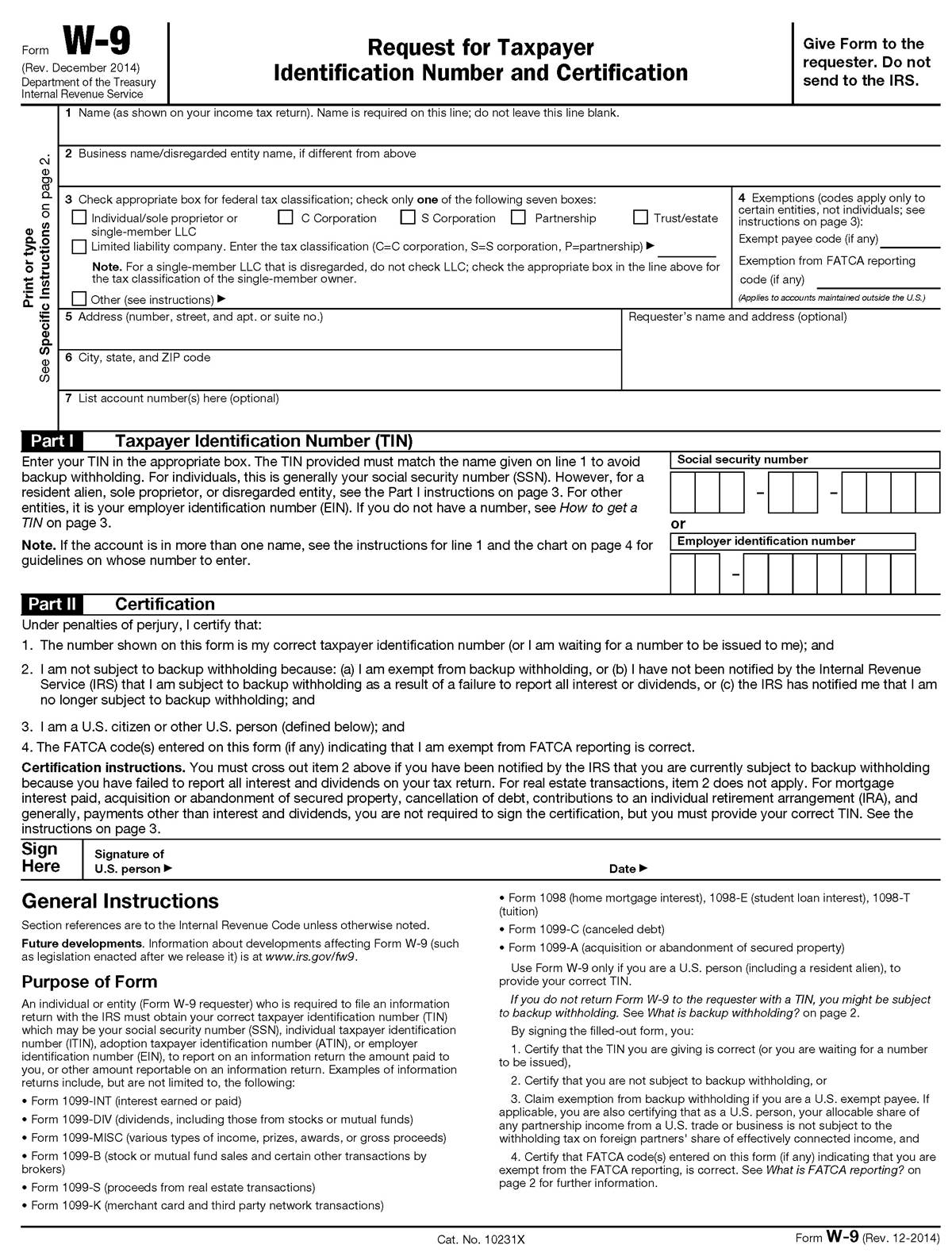

(REMEMBER TO COMPLETE ACCOMPANYING IRS FORM W-9)

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Exchange Offer

1. Delivery of this Letter of Transmittal and Exchangeable Notes; Withdrawal of Tenders. This Letter of Transmittal is to be used by each Holder to tender Exchangeable Notes. The method of delivery of this Letter of Transmittal, the certificates representing the Exchangeable Notes and all other required documents to the Exchange Agent is at the election and risk of Holders, and delivery will be deemed made when actually received or confirmed by the Exchange Agent. If such delivery is by mail, it is suggested that Holders use properly insured registered mail with return receipt requested, and that the mailing be made sufficiently in advance of the Expiration Date to permit delivery to the Exchange Agent prior to 12:00 midnight, New York City time, at the end of the Expiration Date. No alternative, conditional or contingent tenders of the Exchangeable Notes will be accepted. This Letter of Transmittal should be sent only to the Exchange Agent. Delivery of documents to the Offeror, Liberty Media or Delta Topco does not constitute delivery to the Exchange Agent.

The Exchangeable Notes were issued in registered form on the books of Delta Topco, and all of the outstanding Exchangeable Notes are represented by certificates in the names of the registered Holders.

8

VOLUNTARY CORPORATE ACTION COY: LMCA

This Letter of Transmittal may be used by a registered Holder(s) of Exchangeable Notes, whose name(s) appear(s) in the registry of the Exchangeable Notes maintained by Delta Topco, who desire(s) to tender such Exchangeable Notes pursuant to the Exchange Offer. Only a Holder may tender Exchangeable Notes in the Exchange Offer. To tender in the Exchange Offer, a Holder must complete, sign and date this Letter of Transmittal, and mail or otherwise deliver this Letter of Transmittal and the certificate(s) representing the Exchangeable Notes being tendered, together with all other documents required by this Letter of Transmittal, so that they are received by the Exchange Agent before 12:00 midnight, New York City time, at the end of the Expiration Date. Holders of Exchangeable Notes do not need to complete, sign and deliver the transfer notice attached as Exhibit A to the Exchangeable Notes to participate in the Exchange Offer.

For a withdrawal of a tender of Exchangeable Notes to be effective, a written or email notice of withdrawal must be received by the Exchange Agent prior to 12:00 midnight, New York City time, at the end of the Expiration Date and, if such Exchangeable Notes have not been previously accepted for purchase, following 40 business days after the commencement of the Exchange Offer. Tenders of the Exchangeable Notes may be withdrawn by delivery of a written or email notice to the Exchange Agent, at one of its addresses listed on the last page of this Letter of Transmittal. Any such notice of withdrawal must (1) specify the name(s) of the Holder(s) having tendered the Exchangeable Notes to be withdrawn, (2) identify the Exchangeable Notes to be withdrawn (including the certificate number or numbers and principal amount of the Exchangeable Notes, as applicable), and (3) be signed by the Holder(s) in the same manner as the original signature on this Letter of Transmittal by which the Exchangeable Notes were tendered.

2. Minimum Tender Condition; Alternative, Conditional or Contingent Tenders. The Offeror’s obligation to purchase Exchangeable Notes in the Exchange Offer is conditioned upon the Minimum Tender Condition and the other conditions described under “The Exchange Offer—Conditions of the Exchange Offer” in the Prospectus. Because the Minimum Tender Condition requires the valid tender of all outstanding Exchangeable Notes, a Holder must tender not less than all of its Exchangeable Notes to participate in the Exchange Offer. Alternative, conditional or contingent tenders will not be considered valid.

3. Signatures on this Letter of Transmittal. This Letter of Transmittal must be signed by the Holder(s) exactly as the name(s) appear(s) on the certificate(s) representing the Exchangeable Notes.

If any of the Exchangeable Notes tendered hereby are registered in the name of two or more Holders, all such Holders must sign this Letter of Transmittal.

If this Letter of Transmittal is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, such person should so indicate when signing and proper evidence satisfactory to the Offeror and the Exchange Agent of such person’s authority so to act must be submitted with this Letter of Transmittal.

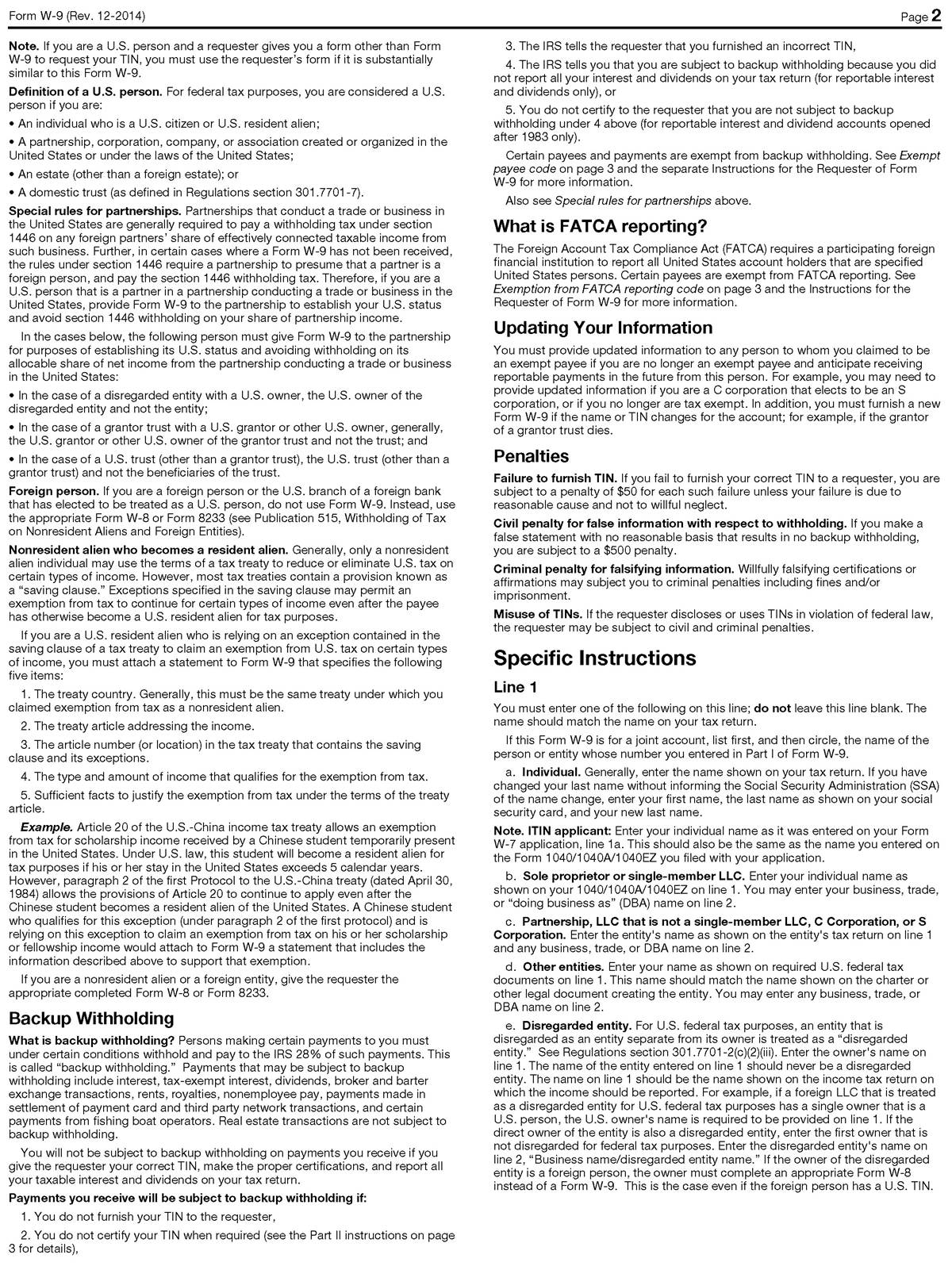

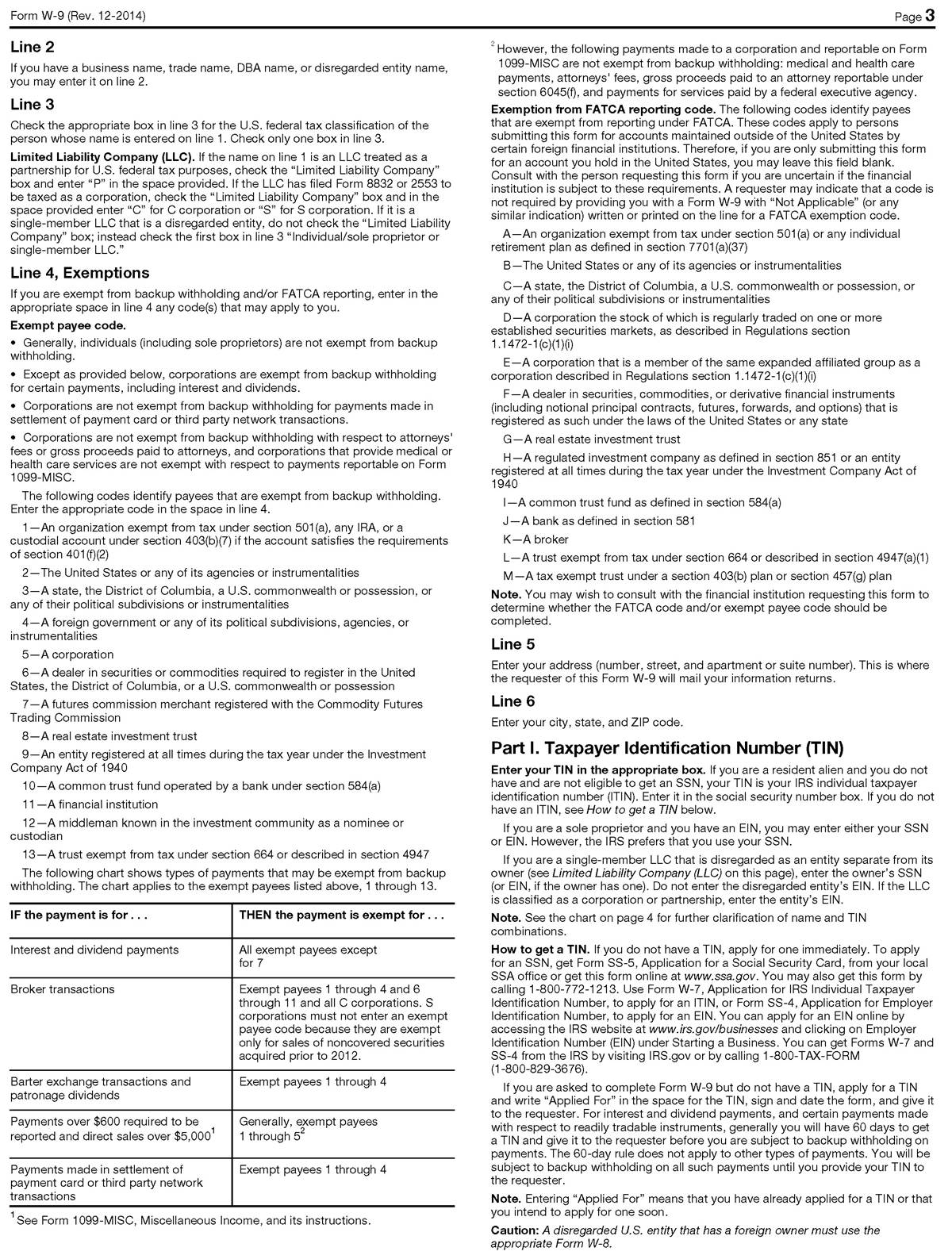

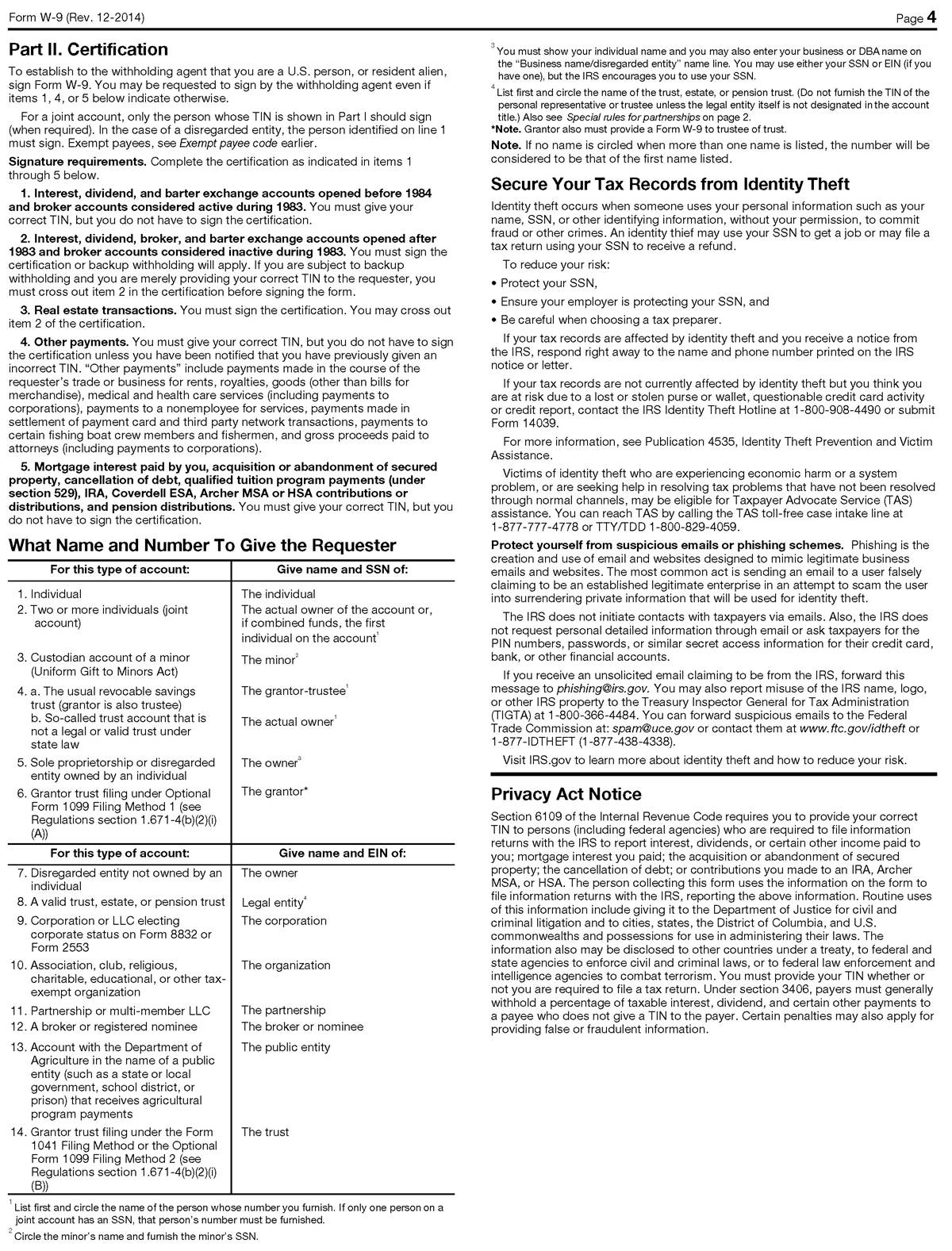

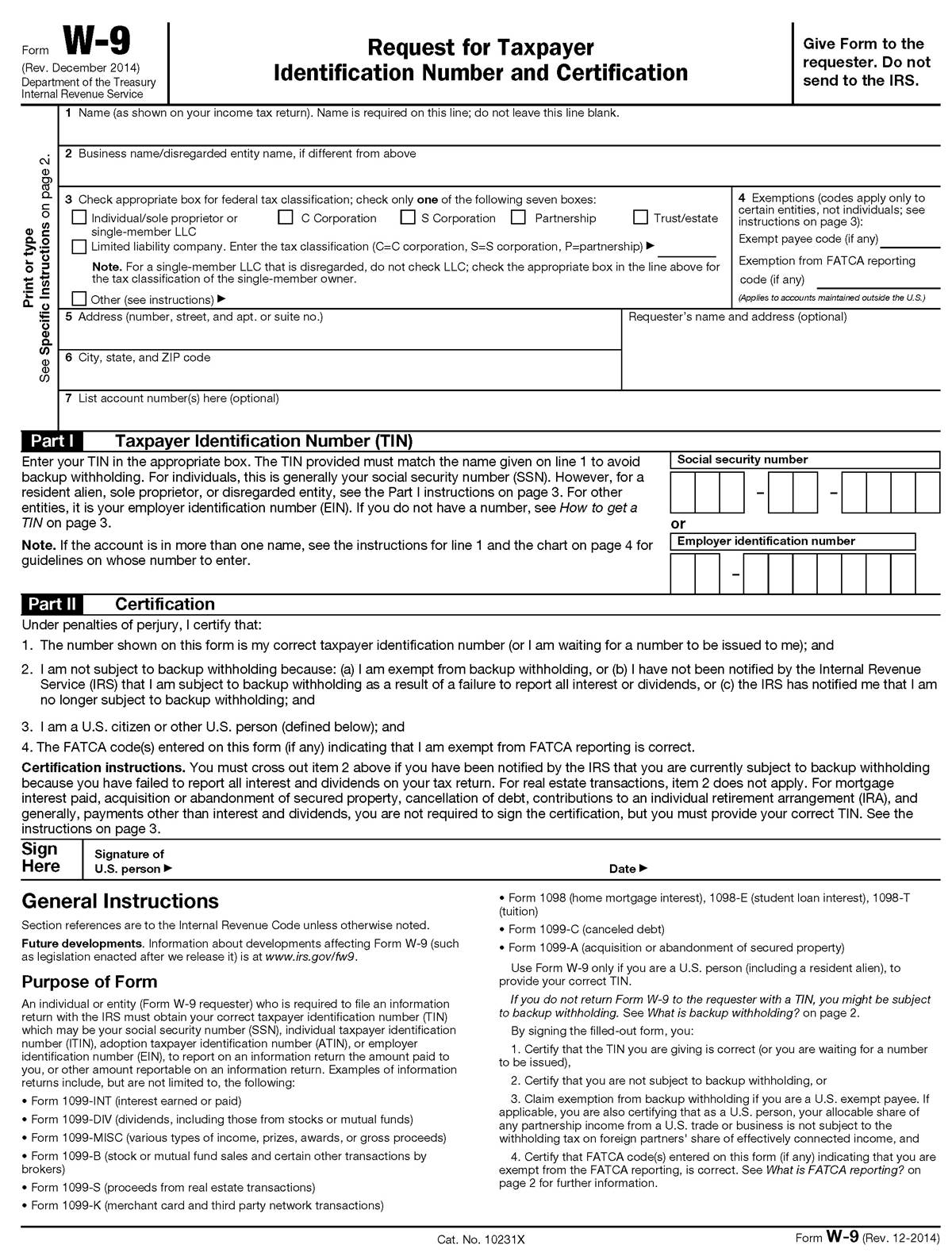

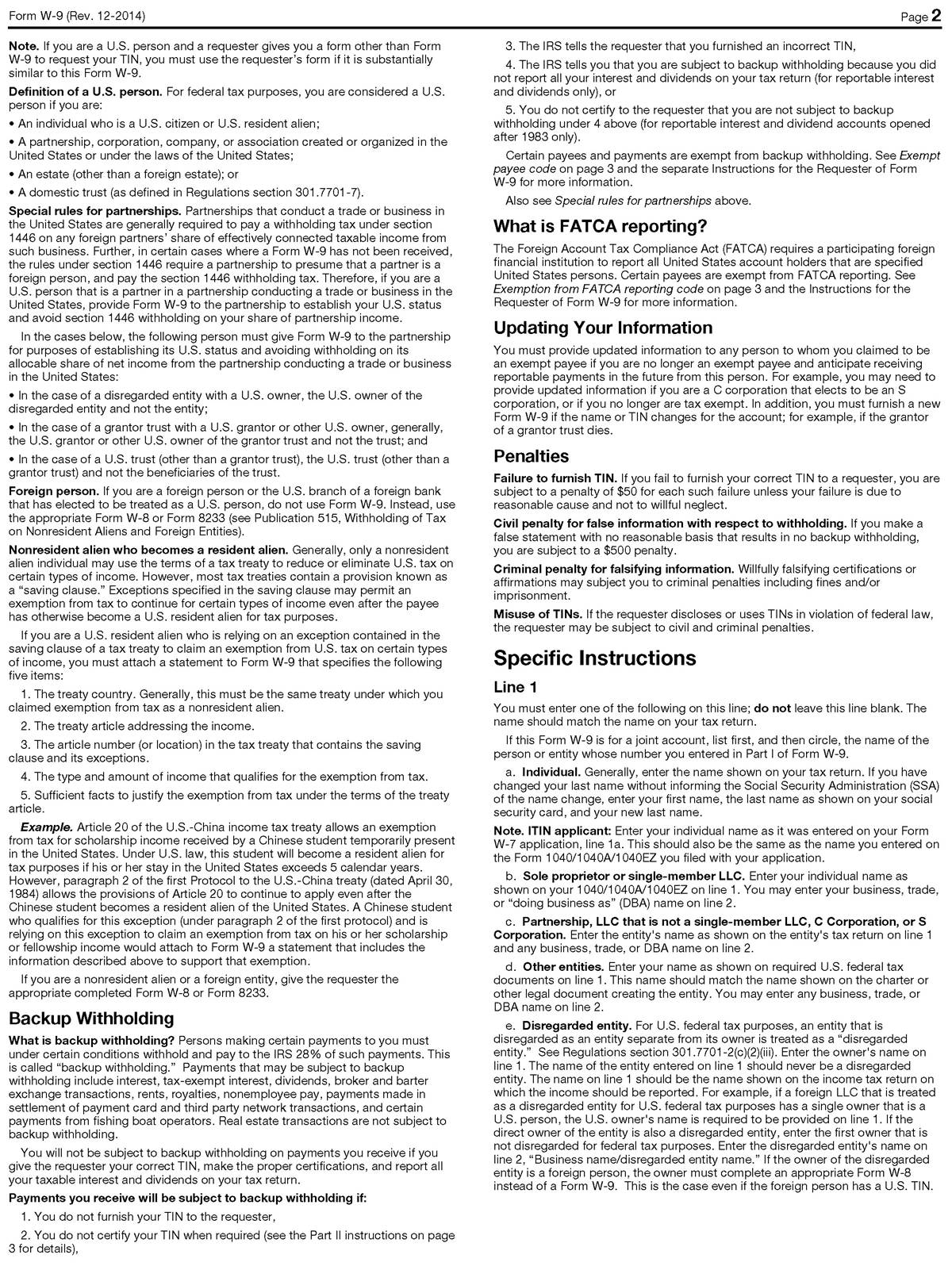

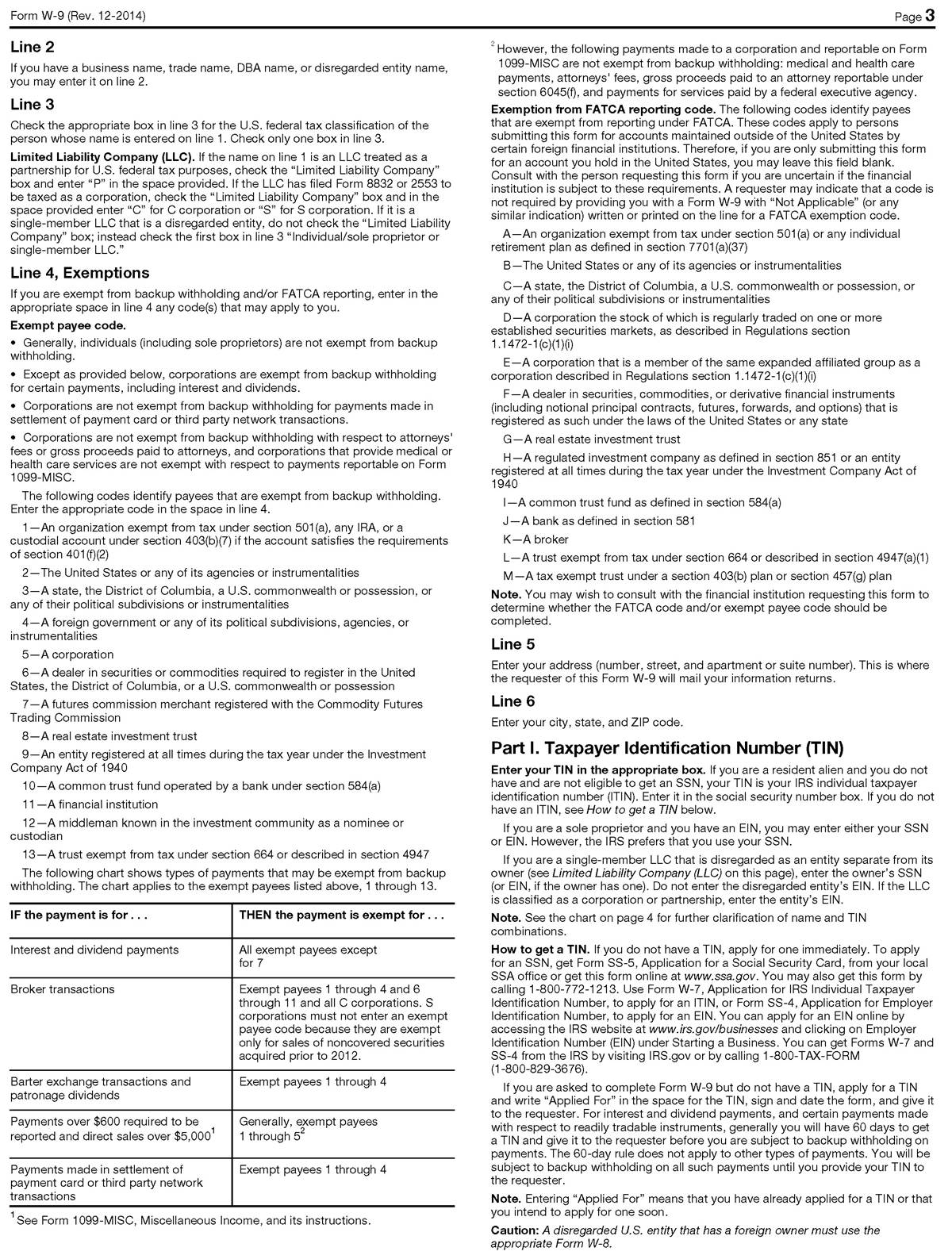

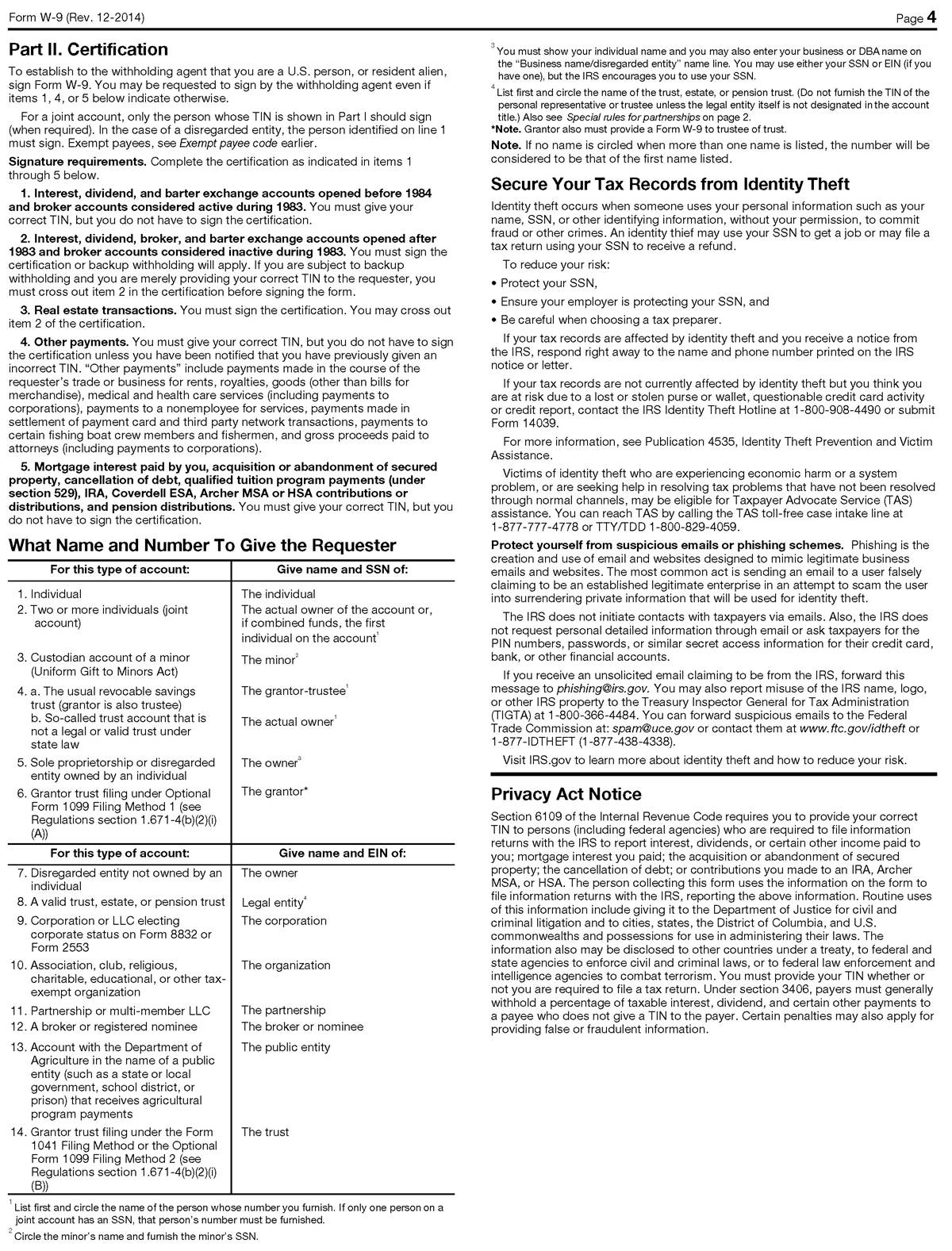

4. Taxpayer Identification Number (“TIN”) and Backup Withholding. Under U.S. federal income “backup withholding” tax laws, the Exchange Agent may be required to withhold a portion of the amount of any payments made to certain Holders pursuant to the Exchange Offer. To avoid such backup withholding, each tendering Holder or payee that is a United States person (for U.S. federal income tax purposes), must provide the Exchange Agent with such Holder’s or payee’s correct TIN and certify that such Holder or payee is not subject to backup withholding by completing the attached Internal Revenue Service (“IRS”) Form W-9. Certain Holders or payees (including, among others, corporations and certain foreign persons) are not subject to these backup withholding and reporting requirements. A tendering Holder who is a foreign individual or entity (for U.S. federal income tax purposes) should complete, sign, and submit to the Exchange Agent the appropriate IRS Form W-8. An appropriate IRS Form W-8 may be obtained from the Exchange Agent or downloaded from the IRS’s website at the following address: http://www.irs.gov. Failure to complete the appropriate IRS Form will not, by itself, cause Exchangeable Notes to be deemed invalidly tendered, but may require the Exchange Agent to withhold a portion of the amount of any consideration paid pursuant to the Exchange Offer.

9

VOLUNTARY CORPORATE ACTION COY: LMCA

Please consult your accountant or tax advisor for further guidance regarding the completion of IRS Form W-9 or the appropriate IRS Form W-8 to claim exemption from backup withholding.

FAILURE TO COMPLETE AND RETURN THE IRS FORM W-9 OR THE APPROPRIATE IRS FORM W-8 MAY RESULT IN BACKUP WITHHOLDING OF A PORTION OF ANY PAYMENTS MADE TO YOU PURSUANT TO THE EXCHANGE OFFER.

5. Transfer Taxes. The Offeror will, subject to the following, pay all transfer taxes, if any, applicable to the exchange of Exchangeable Notes pursuant to the Exchange Offer. The tendering holder, however, will be required to pay any transfer taxes, whether imposed on the registered holder or any other person, if: (i) FWONK shares are to be delivered to, or issued in the name of, any person other than the registered holder of the Exchangeable Notes; or (ii) a transfer tax is imposed for any reason other than the exchange of Exchangeable Notes under the Exchange Offer. If satisfactory evidence of payment of transfer taxes is not submitted with the letter of transmittal, the amount of any transfer taxes will be billed to the tendering holder. The Offeror will not pay or bear any United Kingdom stamp duty which is applicable to the exchange of the Exchangeable Notes pursuant to the Exchange Offer unless such stamp duty is to be paid in order to produce the relevant stamped instrument before any court, arbitrator, referee or other public authority and that instrument could not be given in evidence or relied upon before such court, arbitrator, referee or public authority without the payment of such stamp duty.

6. Irregularities. All questions as to the form of all documents and the validity (including time of receipt) and acceptance of all tenders and withdrawals of Exchangeable Notes will be determined by the Offeror in its sole discretion. The Offeror’s determination will be final and binding. Alternative, conditional or contingent tenders will not be considered valid. The Offeror and the Exchange Agent reserve the absolute right to reject any or all tenders or withdrawals of Exchangeable Notes that are not in proper form or the acceptance of which would, in the Offeror’s judgment or in the judgment of the Exchange Agent or its counsel, be unlawful. The Offeror and the Exchange Agent also reserve the right to waive any defects, irregularities or conditions of tender or withdrawal as to particular Exchangeable Notes either before or after the Expiration Date (including the right to waive the ineligibility of any security holder who seeks to tender Exchangeable Notes in the Exchange Offer). A waiver of any defect or irregularity with respect to the tender or withdrawal of any Exchangeable Note shall not constitute a waiver of the same or any other defect or irregularity with respect to the tender or withdrawal of any other Exchangeable Notes except to the extent the Offeror may otherwise so provide. The Offeror will interpret the terms and conditions of the Exchange Offer and the Offeror’s determination will be final and binding on all parties. Unless waived, any defects or irregularities in connection with tenders of Exchangeable Notes for exchange must be cured within the period of time the Offeror determines. Tenders of Exchangeable Notes shall not be deemed to have been made until all defects or irregularities have been waived by the Offeror or cured. None of Liberty Media, the Offeror, their respective directors or officers or any other person will be under any duty to give notification of any defect or irregularity in any tender of Exchangeable Notes, or will incur any liability to any Holder for failure to give any such notification.

7. Waiver of Conditions. Except as to the conditions that the registration statement of which the Prospectus forms a part be declared effective by the Securities and Exchange Commission (the “SEC”) and that there be no stop order suspending the effectiveness of such registration statement and no proceeding for that purpose having been instituted or that is pending, or to the Offeror’s knowledge, contemplated or threatened by the SEC, which conditions will not be waived, the Offeror may waive any of the conditions to the Exchange Offer in its sole and absolute discretion.

8. Requests for Assistance or Additional Copies. Requests for additional copies of the Prospectus and this Letter of Transmittal may be directed to Liberty Media, at no cost, by writing or telephoning Liberty Media at the following address or phone number:

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, Colorado 80112

Telephone: (720) 875-5400

Attention: Investor Relations

In addition, if you have any questions about the Exchangeable Notes or the Exchange Offer generally, please contact Valerie Jacob or Brian Lewis at Freshfields Bruckhaus Deringer US LLP, counsel to the selling shareholders of Delta Topco in the Formula 1 Acquisition, at +1 (212) 277 4000.

PAYER’S NAME: Computershare

10

VOLUNTARY CORPORATE ACTION COY: LMCA

17-24486-1 C3.2 P50

11

VOLUNTARY CORPORATE ACTION COY: LMCA

17-24486-1 C3.2 P51

12

VOLUNTARY CORPORATE ACTION COY: LMCA

17-24486-1 C3.2 P52

13

VOLUNTARY CORPORATE ACTION COY: LMCA

17-24486-1 C3.2 P53

14

VOLUNTARY CORPORATE ACTION COY: LMCA

THE EXCHANGE AGENT FOR THE EXCHANGE OFFER IS:

You must deliver this Letter of Transmittal, certificate(s), any notice of withdrawal and other materials (if applicable) to one of the below addresses:

|

By Registered or Certified

Mail: |

By Overnight Delivery or

Courier: |

|

Computershare |

Computershare |

|

Attn: Voluntary Corporate

Actions |

Attn: Voluntary Corporate

Actions |

|

P.O. Box 43011

Providence, RI 02940-3011 |

250 Royall Street, Suite V

Canton, MA 02021 |

Notices of withdrawal may also be delivered by email at the following address:

canoticeofguarantee@computershare.com

Only notices of withdrawal may be submitted by email. You must deliver your physical certificate(s), Letter of Transmittal and any other required documents by registered or certificated mail or by overnight delivery or courier to the appropriate address provided above. A Letter of Transmittal or certificate delivered to the foregoing email address will not be accepted and will not be treated as validly tendered for purposes of the Exchange Offer.

If you have any questions about the Exchangeable Notes or the Exchange Offer generally, please contact Valerie Jacob or Brian Lewis at Freshfields Bruckhaus Deringer US LLP, counsel to the selling shareholders of Delta Topco in the Formula 1 Acquisition, at +1 (212) 277 4000.

You may request additional copies of the Prospectus, the Letter of Transmittal or other offer materials, at no cost, by writing or telephoning Liberty Media at the following address or phone number:

Liberty Media Corporation

12300 Liberty Boulevard

Englewood, Colorado 80112

Telephone: (720) 875-5400

Attention: Investor Relations

15

VOLUNTARY CORPORATE ACTION COY: LMCA